Amazon Prime Day sees UK card transactions increase by 12%

Amazon held its annual Prime Day event on the 12/13th July this year. In an environment where online spending has continued to decline from the highs reached in 2020 and 2021 and the current cost-of- living crisis is biting hard, we were curious to know whether this squeeze on incomes might have dulled the consumer love affair with Amazon in 2022.

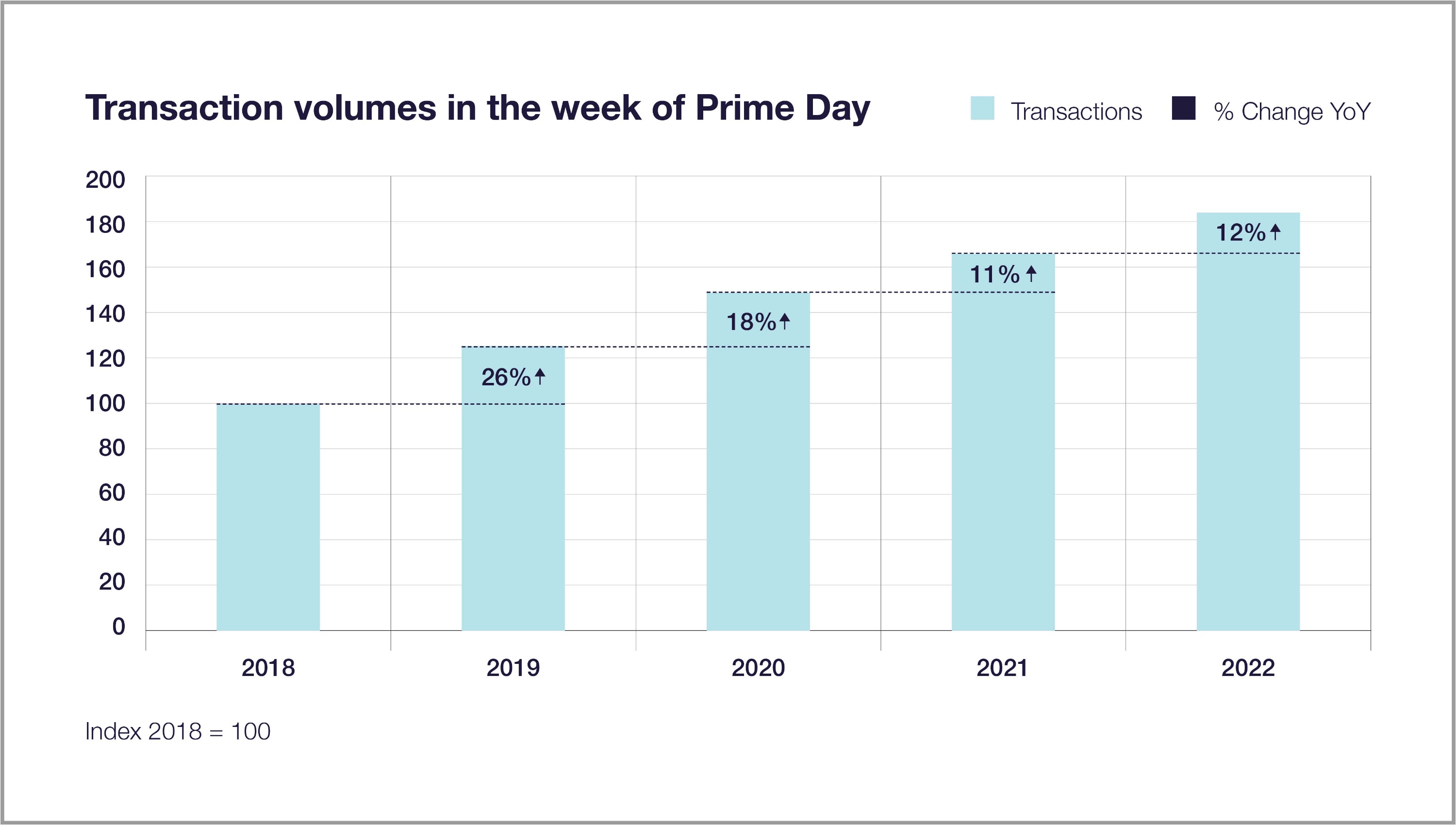

Amazon continues to deliver…However, our data shows that the number of Amazon transactions during the week that this year’s Prime Days took place, rose nearly 12% compared to 2021. While the growth in transaction volumes was below that seen in 2019 and 2020, but still remained in healthy double-digit figures and was slightly up compared to 2021. This means that despite challenging market conditions, Amazon has continued to experience positive transaction growth during the week in which Prime Day falls for the past four consecutive years.

Spend over the week comprising Amazon Prime marked the fourth consecutive year of rising transaction volumes in the UK.

- This year’s event saw another strong jump in transaction volumes, amidst the declines in online spending from the peaks seen in 2020 and 2021, as consumers increasingly return to physical stores.

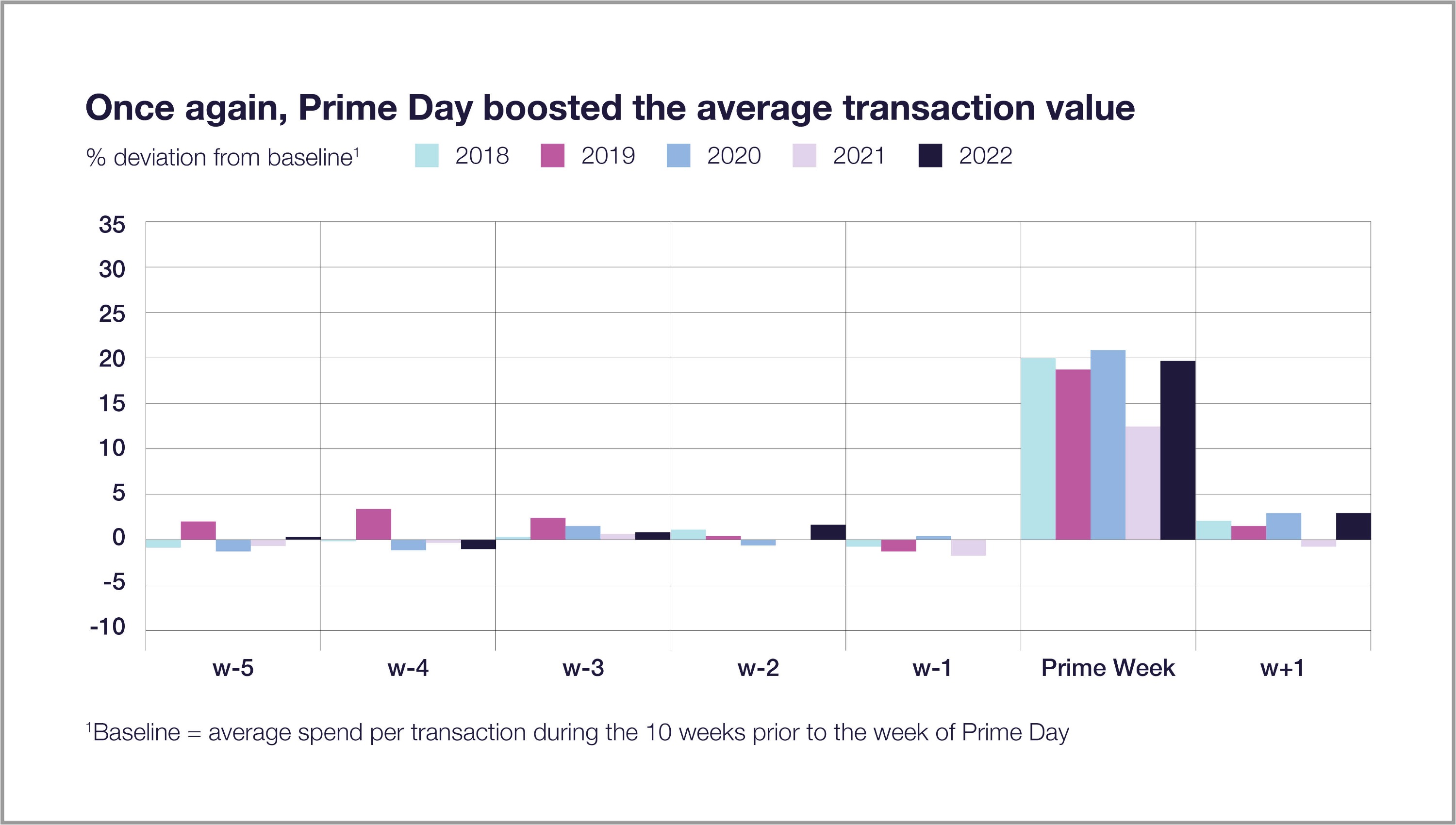

- While we have seen some signs of consumer spend tightening, over the Prime Day period consumers continued to opt for bigger ticket items, with transaction sizes up by 20% compared to the 10-week period prior to Prime Day.

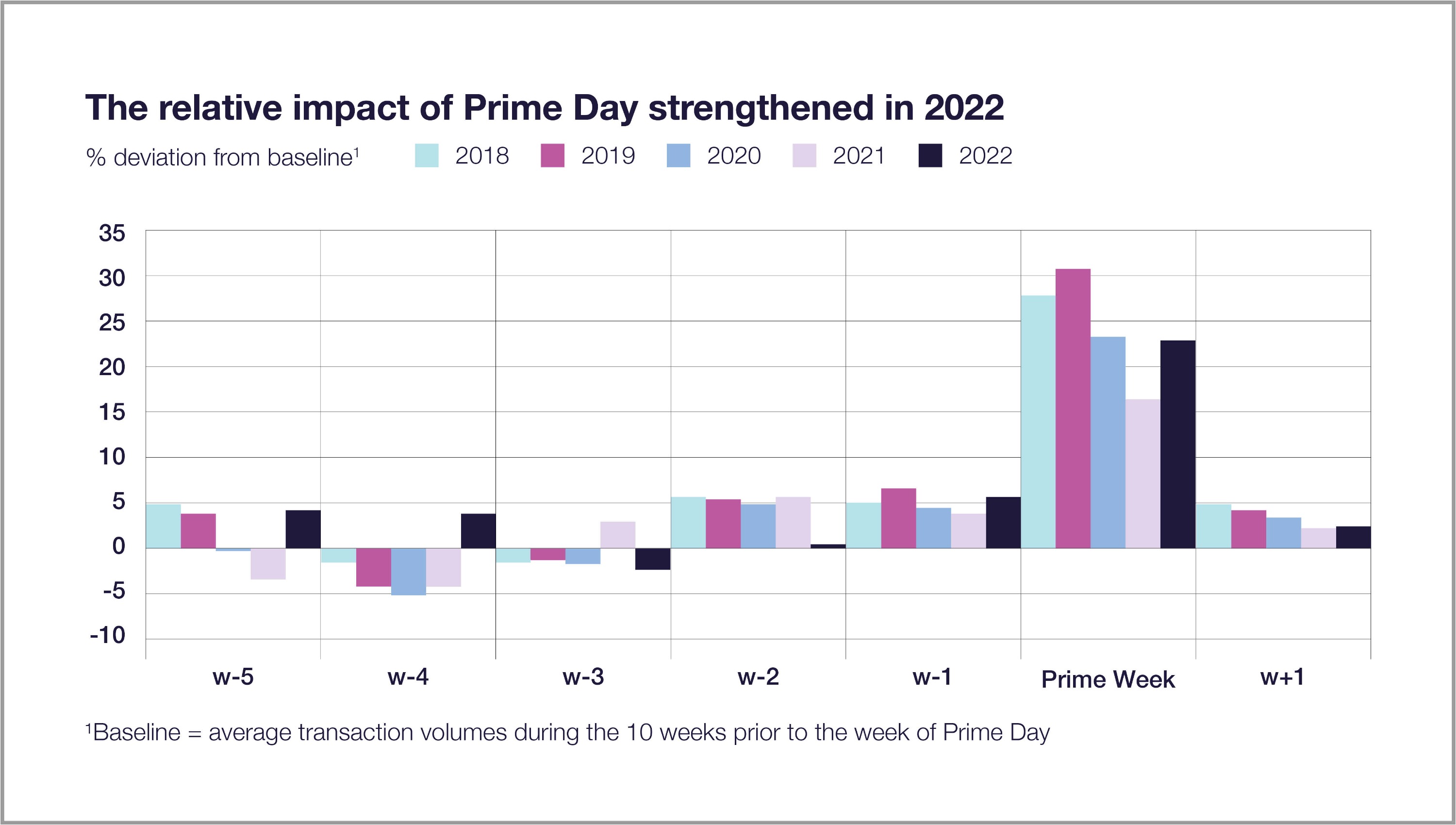

- Transaction volumes jumped 23% over Prime week vs the 10-week average leading up to Prime Day

- The uplift was notably stronger than last year.

By comparing the number of transactions in the week of Prime Day to a normal week, we can gauge true impact.

- This year, the relative impact of Prime Day was notably stronger than in 2021 and was on par with 2019.

- The largest deviations remained in 2018 (28%) and 2019 (31%), possibly due to the general rise in Amazon purchases during the pandemic having limited the relative impact of Prime Day from 2020 onwards.

So what can we tell about the size of consumer purchases? Similar to prior years, we saw consumers opt for bigger ticket purchases during the Prime Day period.

- This year consumers spent on average 20% more than usual. Such a deviation is in line with past Prime Days, aside from 2021 when the increase was much smaller.

- Consumers not only transacted more but made bigger purchases as well.

With events such as Black Friday and Cyber Monday still to come later in the year, the Amazon experience bodes well.

Data Insights Team, Fable Data, insights@fabledata.com

Avinash Srinivasan, Fundamental Equity Analyst, Fable Data, Avinash@fabledata.com

Anoop Bindra Martinez, Strategic Partnership Associate, Fable Data, Anoop@fabledata.com

Fabio Saia Cereda, Economist, Fable Data, fabio@fabledata.com

About Fable Data Fable Data is an Award winning pioneer in the European consumer transaction data market. We own the most comprehensive anonymised dataset of European real time banking and credit card data, supplied directly from source and based on millions of European consumers. We supply detailed performance metrics at an individual merchant level and across business sectors – enabling merchants to actively benchmark competitor performance, locally and nationally. We also work closely with central banks, institutions, and academics, to ensure that our ground breaking data and analysis is shared, at no cost, with global decision makers.