Data for Good and how real-time transaction data enriches economic policy and research

To make economic decisions, we need to understand how people and businesses spend their money. To do this, government and academics have historically had to rely on datasets that are small or significantly delayed. However, with the advent of digital economies, we are seeing a new wave of economic research and statistics based on large-scale anonymised transaction datasets. Such data helps us to understand and react to economic movements in real time, without the recurring risk of significant data revisions.

Fable was founded with a mission to provide better data to decision makers everywhere, including governments and academics. This is Fable’s ‘Data for Good’ philosophy. In this blog, we provide examples of how institutions such as the IMF, Eurostat, and the University of Nottingham are working with Fable’s European transaction data to advance economic thinking.

Changing the face of global policymaking forever

According to a recent IPSOS survey, inflation is currently the leading global concern amongst the public [1]. Inflation has been a persistent theme of 2022, with policymakers across the world debating how best to measure and address the issue.

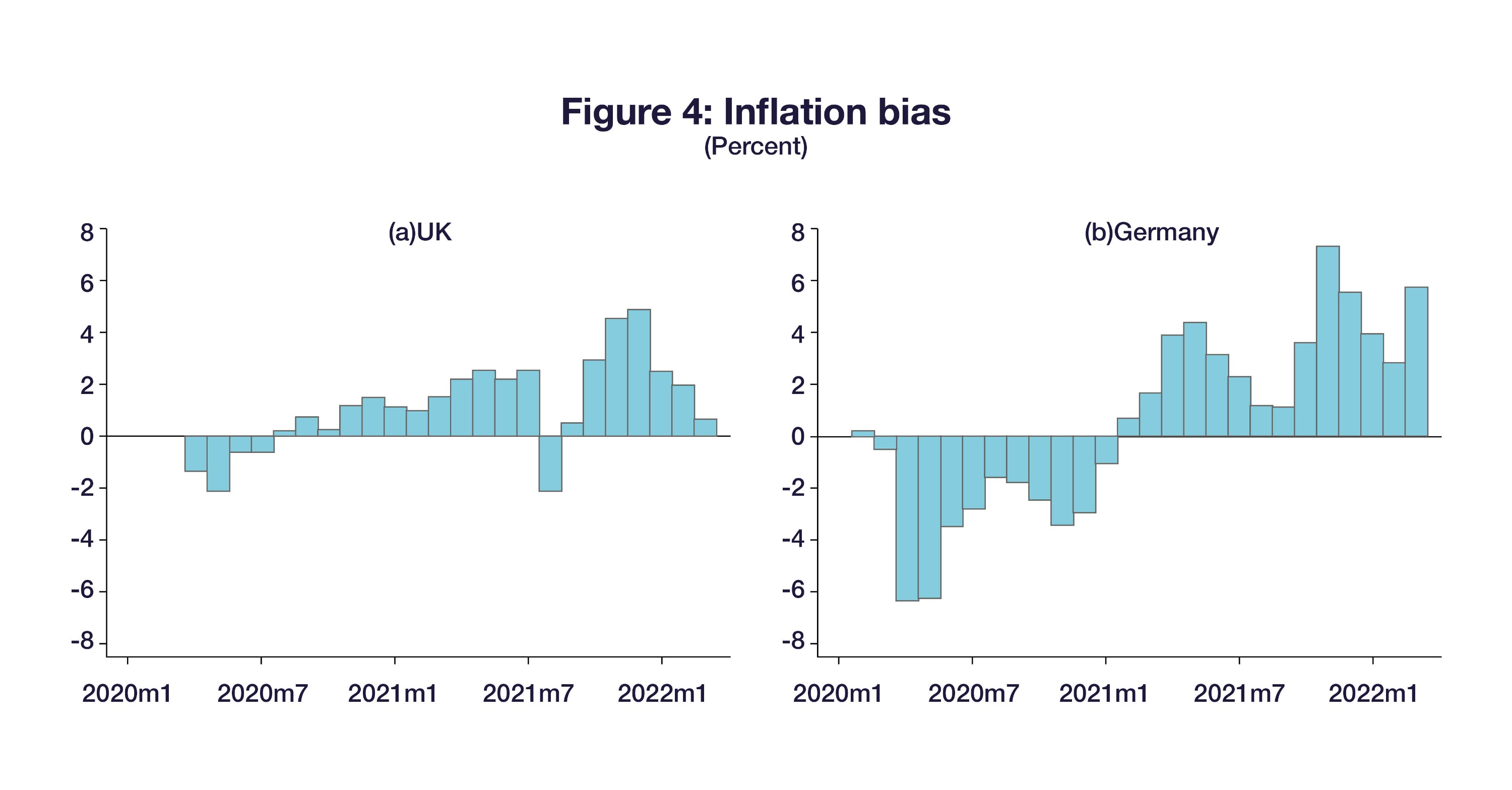

Last month, the International Monetary Foundation (IMF) released a paper exploring alternative ways to measure inflation [2]. It argued that the weights used to measure inflation can quickly become outdated if consumption habits suddenly change, as witnessed during the global COVID-19 pandemic. The paper showed how Fable’s transaction data can be used to update the official inflation weights in a timelier manner and hence quantify the resulting inflation bias.

Why is this so significant? Inflation is one of the key metrics used globally by policymakers to determine monetary policy and government spending. Policymaking relies upon the accurate measurement of inflation and ultimately this affects every one of us as consumers, taxpayers, and savers.

Anonymised real time spend data provides one of the most accurate reflections of inflation available, providing actionable insights to enhance the basis of economic decision making globally. Read the full Paper here.

Enhancing existing data sources to deliver better outcomes

Another exciting application of anonymised spend data is aiding the vital calculation of official statistics and the work of statistical agencies. Fable is proud to be supplying a sample dataset for Eurostat’s European Big Data Hackathon 2023. The event involves participants from national statistics agencies across the EU competing in teams to solve a statistical challenge using Fable’s spend data. The teams’ outputs will demonstrate how the powerful combination of official statistics and big data can be used to collectively “inform policy makers [on] pressing policy questions facing Europe.” [3] Keep an eye out on Fable’s social media channels as we will have more exciting updates about this event soon!

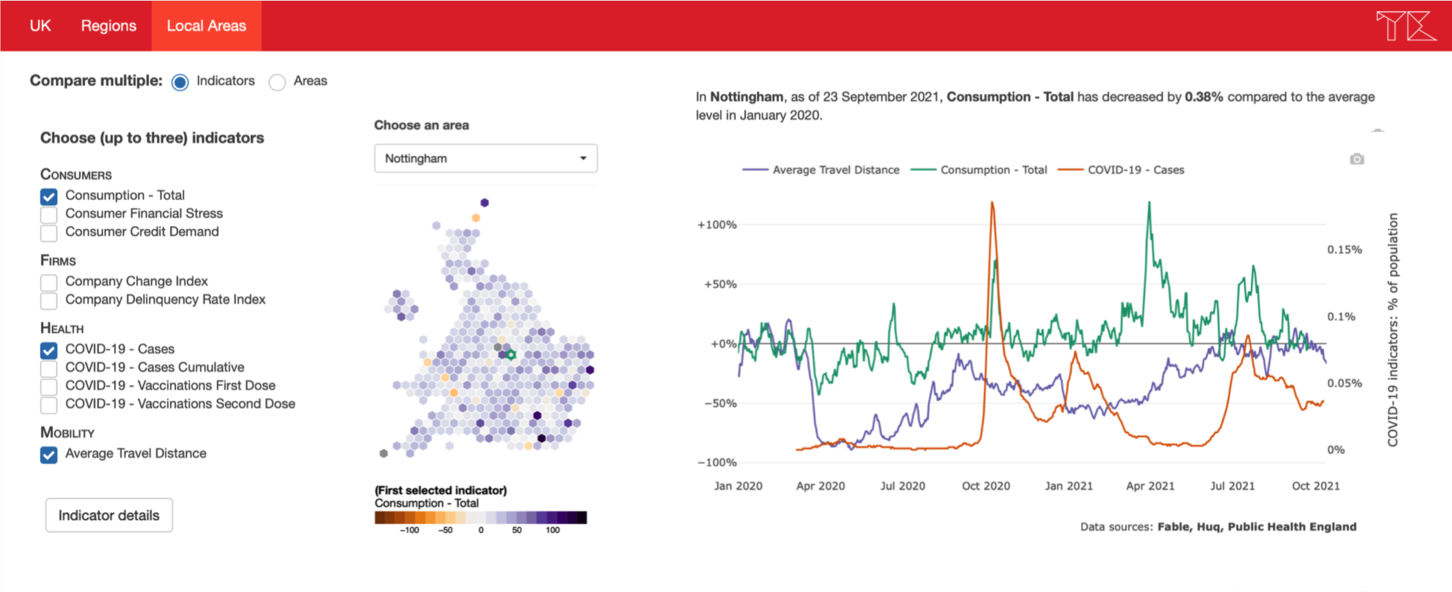

Fable also works closely with universities and academics to support the latest research and economic thinking. Here, we see large-scale transaction datasets being used for both macro and micro economic analysis. For example, the University of Nottingham launched their ‘Track the Economy’ dashboard, which displays multiple sources of aggregated data including Fable’s anonymised spend data. [4] The dashboard aims to support managerial decision making and policy formulation by providing real time insights on UK regional economic activity. Read more about ‘Track the Economy’ and access the dashboard, here https://www.tracktheeconomy.ac.uk/teabout].

Real time transaction data holds the key

There are many ways that real time transaction data is being used by economists, statisticians, and academics. Fable’s ‘Data for Good’ initiative shows the importance of collaboration and shared thinking between the public and private sectors. Our enduring belief and ambition is to provide better data to economic decision-makers across the globe, enriching both societies and lives in the process.

Ben Gibbons, Partnerships, ben@fabledata.com

[1] https://www.weforum.org/agenda/2022/10/worries-inflation-economy-concerns/

[3] https://ec.europa.eu/eurostat/cros/BD_Hackathon2021_en

[4] https://www.tracktheeconomy.ac.uk/

About Fable Data

Fable Data is an Award winning pioneer in the European real time consumer transaction data market. We own the most comprehensive anonymised dataset of European banking and credit card data, supplied directly from source and based on millions of European consumers. In addition to partnering with leading financial providers, Fable has a stellar client base of global Tier 1 Investors and Fortune 500 companies. We also work closely with central banks, institutions, and academics, to ensure that our ground breaking data and analysis are shared, at no cost, with global decision-makers.

Fable’s real-time view of the global economy informs better decision-making in business, government, research, and development.