Finding the features: Same stores, eCommerce and key value items

Anonymised consumer transactions lack Personal Data but contain information that we can use to create detailed features to better understand the underlying performance of a business. Total sales and transactions are great predictors of total revenue, but there are deeper signals that are better predictors of profit. One of the first questions an investor asks is “how are same store sales trending?” Adding 5% to the store estate should grow sales by more than 5% if the stores are in the right places. Similarly, closing the worst performing 5% of stores should not hit total sales by 5%.

Our transaction strings contain markers of a store location such as a store number, town and postcode. Through aggregating sales at outlet level, we can count how many stores are trading continuously, how many closed and how many new stores opened.

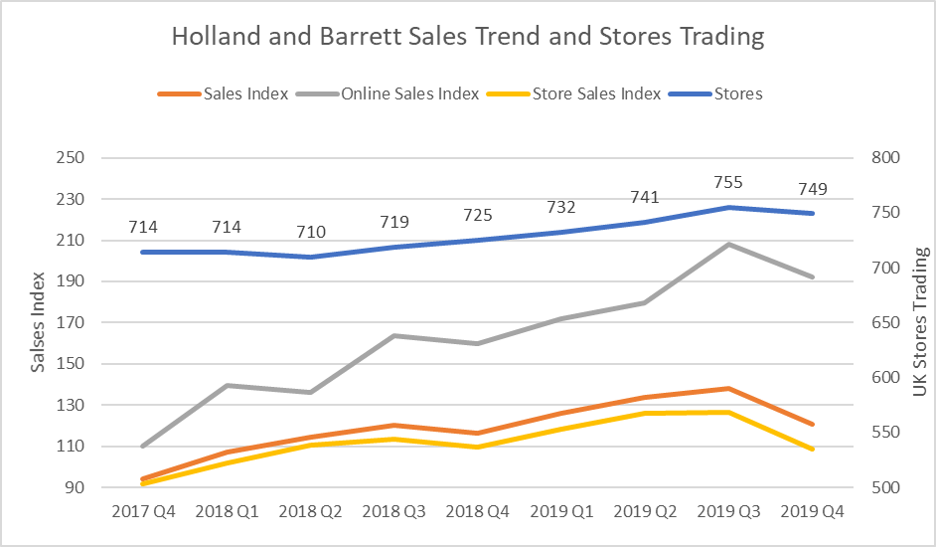

Holland and Barrett is a health store that LetterOne purchased from the Carlyle Group in 2017. For the quarter ending 31 December 2019, reported total sales rose 4.8% and same store sales rose by 3.3%. The Fable Data panel gave an early signal on these results. Over the last 2 years, we’ve tracked the size of the Holland and Barrett store estate and seen concession stores open within Tesco supermarkets in Leeds, Rochdale and Cardiff increasing the store footprint to 750 in the UK. These are example string patterns for Holland and Barrett transactions that allow us to monitor store numbers and online sales

WWW.HOLLANDANDBARR

HOLLAND AND BARRETT TESCO CARDIFF GBR

HOLLAND & BARRETT MANCHESTER MA

HOLLAND & BARRETT STRATFORD LON

HOLLAND & BARRETT MILTON KEYNES

Our panel spend index shows 20% total sales growth over 2 years as the store estate grew by 6%. We can go to a deeper level still and split out eCommerce sales from stores. We see the average store transaction coming in at £18, whilst online transactions are £33 typically. Online sales have nearly doubled over the last 2 years and are the main growth driver for the business. We obviously have no signal on store cash transactions, and so our view on the contribution of eCommerce is overstated, but the Fable Panel tells us that online is now worth 20% of total sales. Investors are well aware that the competitors on the internet and the high street are different.

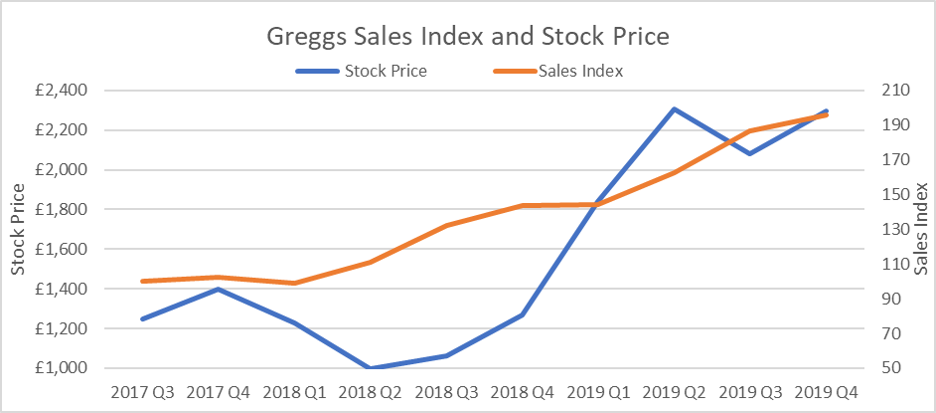

Greggs plc (LSE: GRG) is the largest bakery chain in the UK and has had 2 great years. The stock price doubled as consumers have pilled in for bacon rolls, sandwiches and donuts.

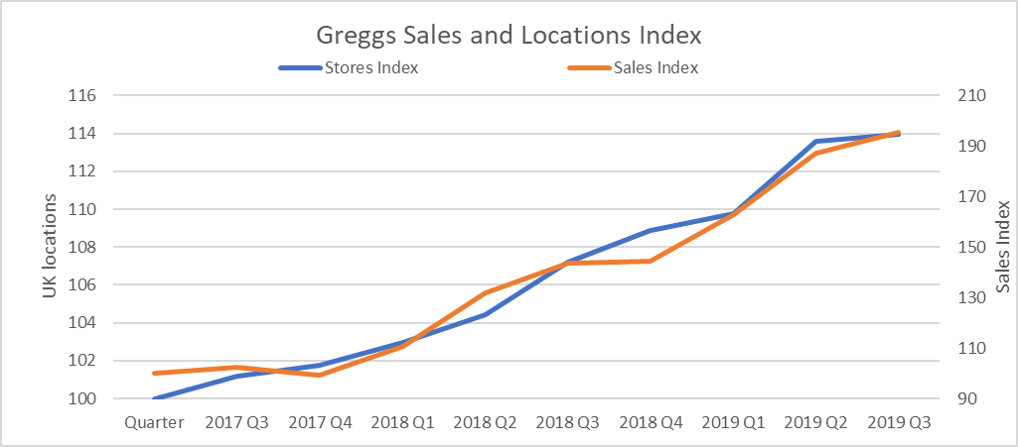

Our panel tells us that Greggs grew the number of towns where it has a bakery by 14% and that sales jumped by 80% over the same period. Knowledge of the sales signal before the quarterly statement is valuable information. The stock price jumped by 15% in November 2019 on the back of stronger than expected revenues.

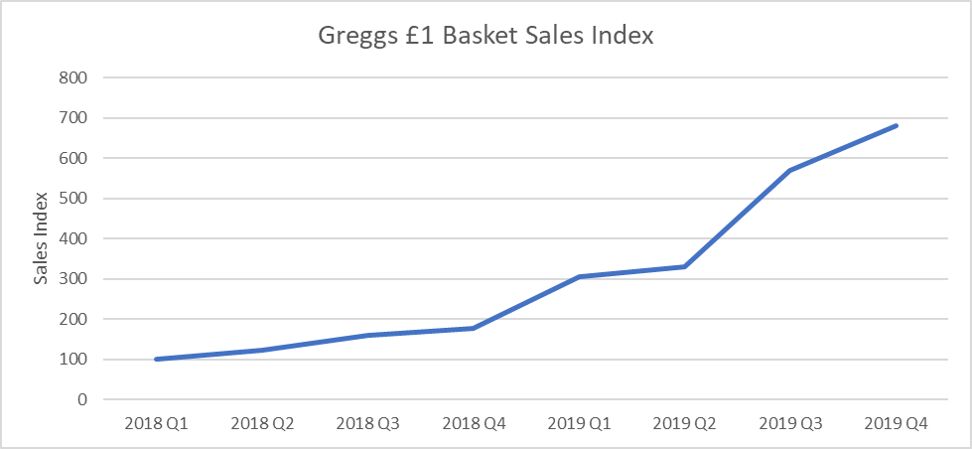

Greggs successfully capitalised on the vegan trend. It put vegan sausage rolls in all shops in March 2019. The product sells for £1 and we can track the quantity of £1 baskets. We saw the boom in the vegan sausage roll first.

For more information about our data and our Data Science team, you can contact Dr Mark Howland, Chief Data Scientist, mark@fabledata.com