MCC

The MCC is much more than a fancy dress club for the custodians of the Home of Cricket.

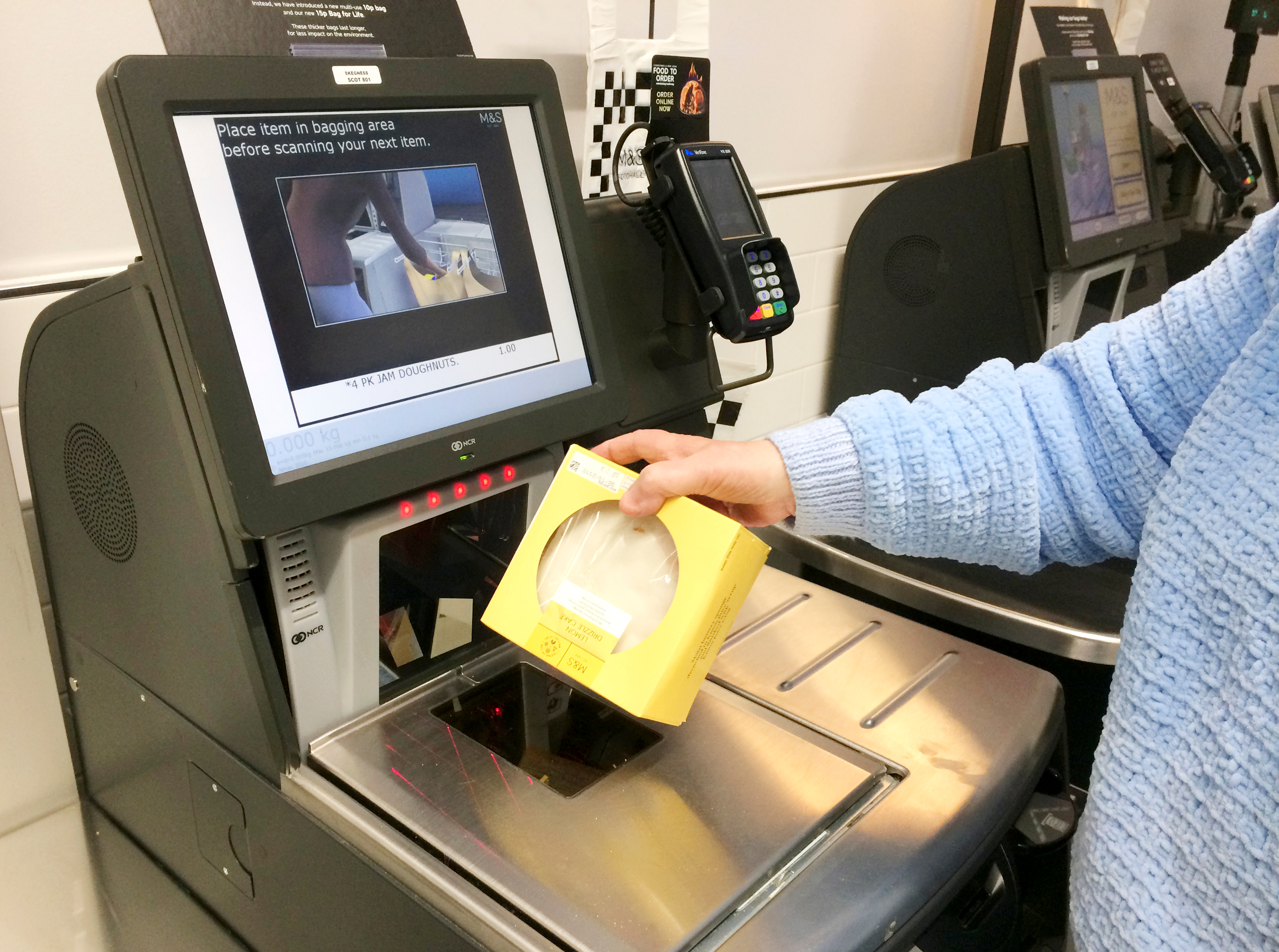

Card issuers use a Merchant Category Code to classify a business based on the goods and services it sells. Builder’s merchants, opticians and confectionary vending machines all have MCCs. Payment networks also use the MCC to set restrictions for authorisation and payment limits. Pay at pump fuel transactions at Morrisons, the electronics counter at John Lewis and the Starbucks app all have different spend caps and authorisation mechanisms. If you have a points or cashback credit card, the MCC determines if you get a reward and the earn rate. It also helps you track your monthly spending on groceries, travel, leisure etc in your banking app. If you are particularly vigilant you may have spotted SACAT on your bank statement, which means Semi-Attended Cardholder Activated Terminal, and it will remind you of the “unexpected item in bagging area” and the voice inviting you to present your loyalty card.

These are example MCCs

- 8043 Opticians/ Opticians Goods and Eyeglasses

- 5912 Drug Stores and Pharmacies

- 5411 Grocery Stores/ Supermarkets

- 3005 British Airways

- 5542 Automated Fuel Dispensers

MCC is valuable data for our clients for a few reasons. It allows us to split the sales of a large merchant down into more detailed lines of business with different levels of tax and margin rate. This is much more granular than the way that quarterly results are reported and gives insight on future performance trends. For example, we can trend the convenience, supermarket, fuel, and ecommerce sales of the big grocers. We can also infer the sales contribution from pharmacy, opticians and cosmetics at drug stores by looking at the combination of the payment amount, MCC and terminal type (attended vs non attended). An early read on detailed business performance is gold dust.