As pubs reopen in the UK, is it still Rishi’s round?

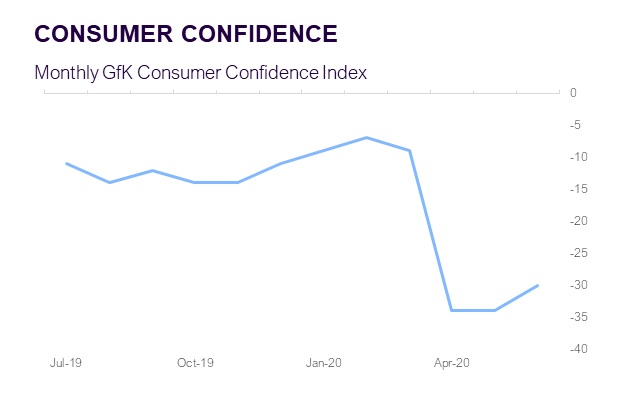

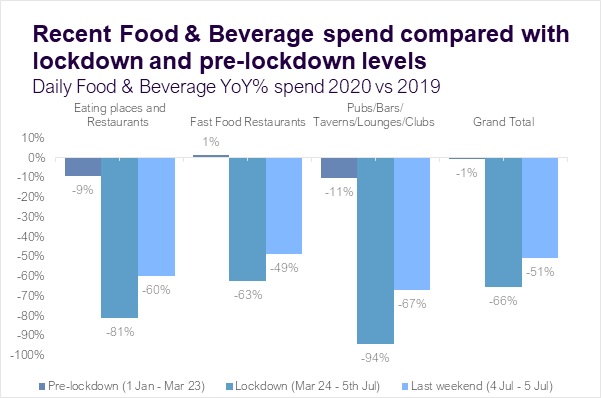

Pub and restaurant spend improved from –66% YoY to –51% YoY, following last weekend’s reopening, as Fable Data informs the government case for economic intervention. Real time data sources – such as Fable Data – are influencing government policy, as the Treasury battles to protect the UK economy. Currently the Treasury has an extremely challenging task on its hands to improve consumer confidence, which has fallen off a cliff since March 2020. As lockdown measures are relaxed, the recovery may not be V-shaped, or even U-shaped, because the upswing may not take the UK back to pre-COVID levels of economic activity.

The government’s strategy relies on unprecedented interventions, including the further measures announced today in Rishi Sunak’s Summer statement, such as job placements, stamp duty and VAT reductions, job retention bonuses, restaurant vouchers, home insulation grants, and new jobs schemes for young people, to name just a few. With debt servicing costs so low and economic risk so high, our Chief Economic Advisor Kitty Ussher expects further stimulus leading into the Autumn budget, if it is needed. The government will rely on real time sources of economic data, including Fable Data, to track the performance of the economy and the degree of required intervention.

Drop in UK Consumer Confidence

Fable Data provides the government with real time spending data about the UK and the wider European consumer economy, using anonymised spending data from millions of consumers and businesses. We also work with economic decision makers in the investment and corporate sectors.

This weekend was a key turning point for the UK as pubs, bars and restaurants started to reopen. At Fable, we are measuring the recovery, and to what degree and when a ‘new normal’ is established.

A good start as pubs and restaurants open across the UK, but food and beverage spend remains well below pre-lockdown levels

Our spending data shows an improvement across the board in spending at food and beverage outlets, in comparison to the period of UK lockdown. However, spending levels are still far below the pre lockdown periodof 1 January to 23 March, and may continue to be so due to capacity restrictions. Fable will continue to monitor the reopening of the hospitality industry, and we are able to view the data by merchant and location.

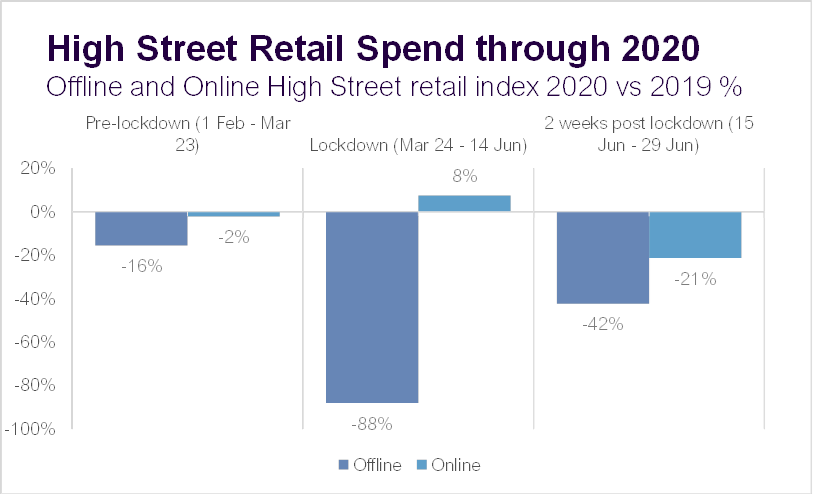

Recent high street bounce has moderated over the last two weeks and online spend has moved negative YoY.

High street spend was weak at the start of the year, particularly bricks and mortar spending levels which were -16% YoY from 1 February to 23 March. During lockdown, spend fell by 88%, partially offset by online spend growth of +8% YoY. Since lockdown rules wererelaxed on 15 June, online spend has reversed and declined to -21% YoY. The bricks and mortar spend has remained negative, at -42% YoY, but this is a marked improvement.

The UK government will continue to watch many data sources to measure the health of the UK economy. Fable Data supplies real time consumer data that is well stratified and representative of the wider economy. We verify our data quality by correlating it to official published sources, such as the ONS (Office of National Statistics). Our data correlates strongly and is available three weeks earlier than ONS reporting.

If you want to subscribe to our weekly report, or to get access to our data, contact us:

Stephanie Goulden, Business Development Director at stephanie@fabledata.com

Media enquiries to: media@fabledata.com