Grocery demand soars whilst takeaway delivery growth moderates

The shelves of Grocery stores have been emptied as consumers rush to buy up food and medicine despite retailers assuring the public that there is no need to panic. It has been difficult to get an online grocery delivery slot as demand has soared. Consumer behaviour is changing rapidly.

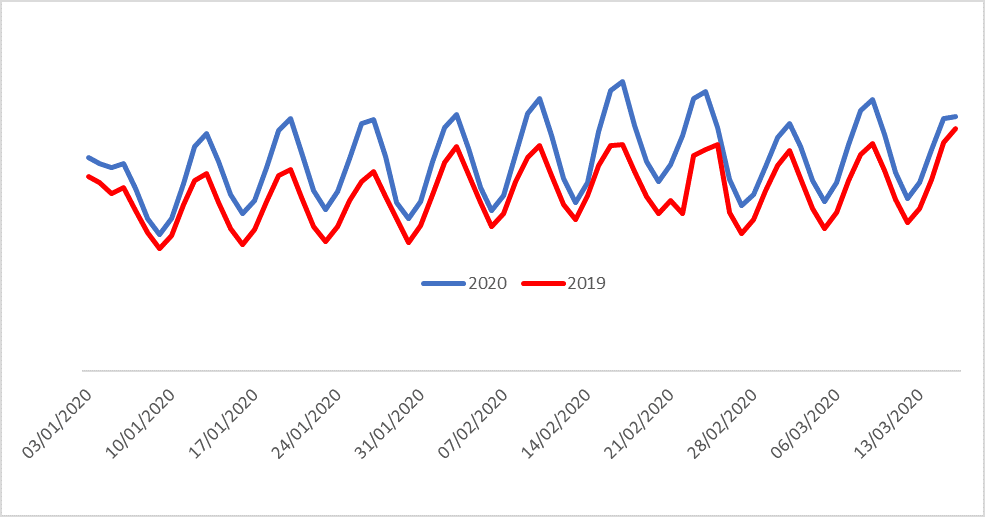

Our hypothesis was that UK consumers were ordering more takeaways following Government advice to not go to restaurants, bars and pubs. We used the Fable panel and looked at the combined performance of Deliveroo, JustEat and Uber Eats to see how this group of merchants is trading.

Our Data indicated that 2020 started off as a good year for the sector with average year on year growth of 18%. However, in the last couple of days, year on year sales are now only 5% to 10% higher as consumers start to avoid unnecessary contact and maybe have a full refrigerator.

Chart shows daily sales trend for Deliveroo, JustEat and Uber Eats for 2019 and 2020

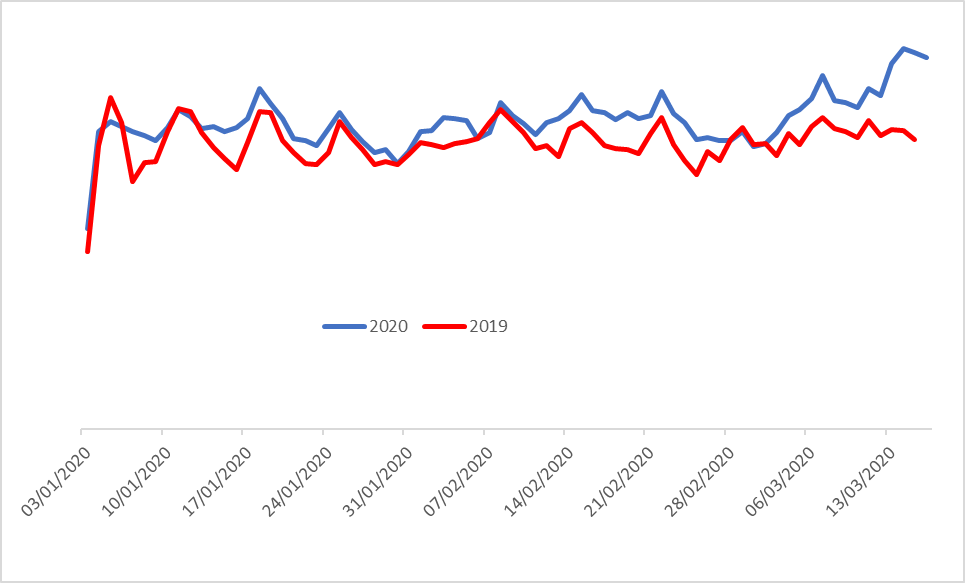

We also looked at the sales trends at grocery stores and for online grocery delivery. Delivery is constrained by the capacity of the people picking the items and driving the vans. Year on year sales were up 18% in January 2020 but have now surged to +30% in the last couple of days. The average value of an order has jumped from £75 to £89 as people make the most of delivery capacity whilst they have a slot.

Chart shows year on year trends for grocery home delivery sales for Tesco, Asda, Sainsbury’s, Morrisons and Ocado for 2019 and 2020

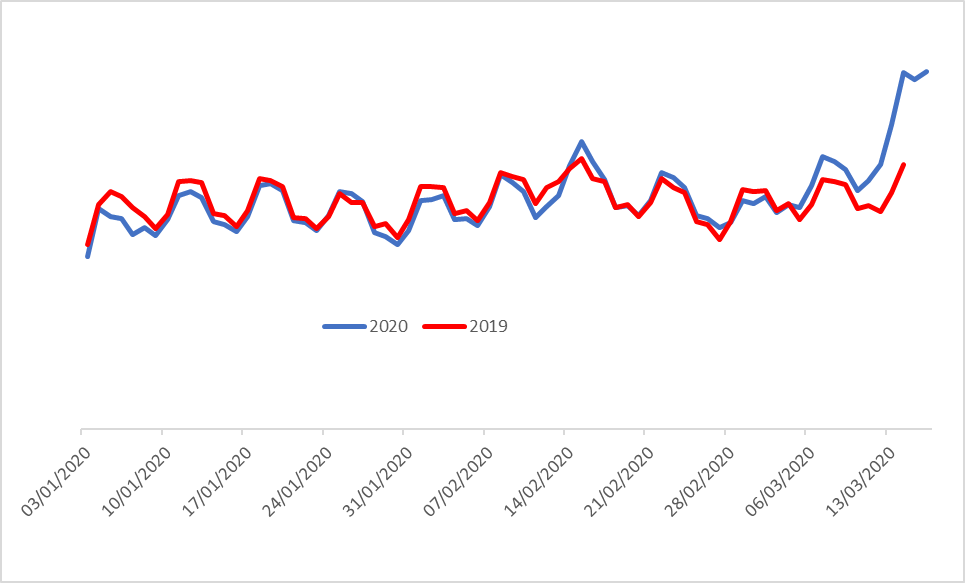

Morrisons announced on 17th March that it will create 3,500 new jobs to expand its home delivery service amid the coronavirus pandemic. Grocery store sales also saw a big demand spike, but do not have the same delivery constraints and are limited only by products on shelves. Store sales had been flat year on year but have surged over the last week. 14th to 16th March saw a 40% spike in sales versus prior year.

Chart shows year on year trends for Tesco, Asda, Sainsbury’s, Morrison’s, CO-OP, Aldi, Lidl and M&S Food for 2019 and 2020, excluding online sales, but including Express and Local store formats

At Fable Data, we can break these numbers down for individual companies and even at the individual store, regional and demographic level. Get in touch for more information.