Q-Commerce is here to stay, what impact is it having on mainstream competitors?

Quick Commerce has enjoyed rapid growth over the past couple of years, with nascent organisations enjoying sizeable valuations. Getir was valued at $12bn in March 2022 in their Series E; Gorillas was valued at $2.1bn in October 2021 in their Series C, and Zapp has raised over $300m. Whilst the volatile economic environment is challenging some of these valuations, one thing is for sure, Q-Commerce organisations are shaking up the Grocery landscape and the incumbents need to have a clear and fast strategy on how to manage this strongly emerging threat.

We interrogated Fable’s extensive consumer spend data to track the live usage of 30,000

Q-Commerce customers in the UK. We specifically looked at demographics – who are the main users and how has QC impacted competing grocers and food delivery companies?

So, who does Quick Commerce appeal to and how much are they spending?

With premium prices charged by Q-Commerce operators, it is not surprising that the customer base is dominated by those earning over £60,000 and living in London districts that are dominated by young professionals.

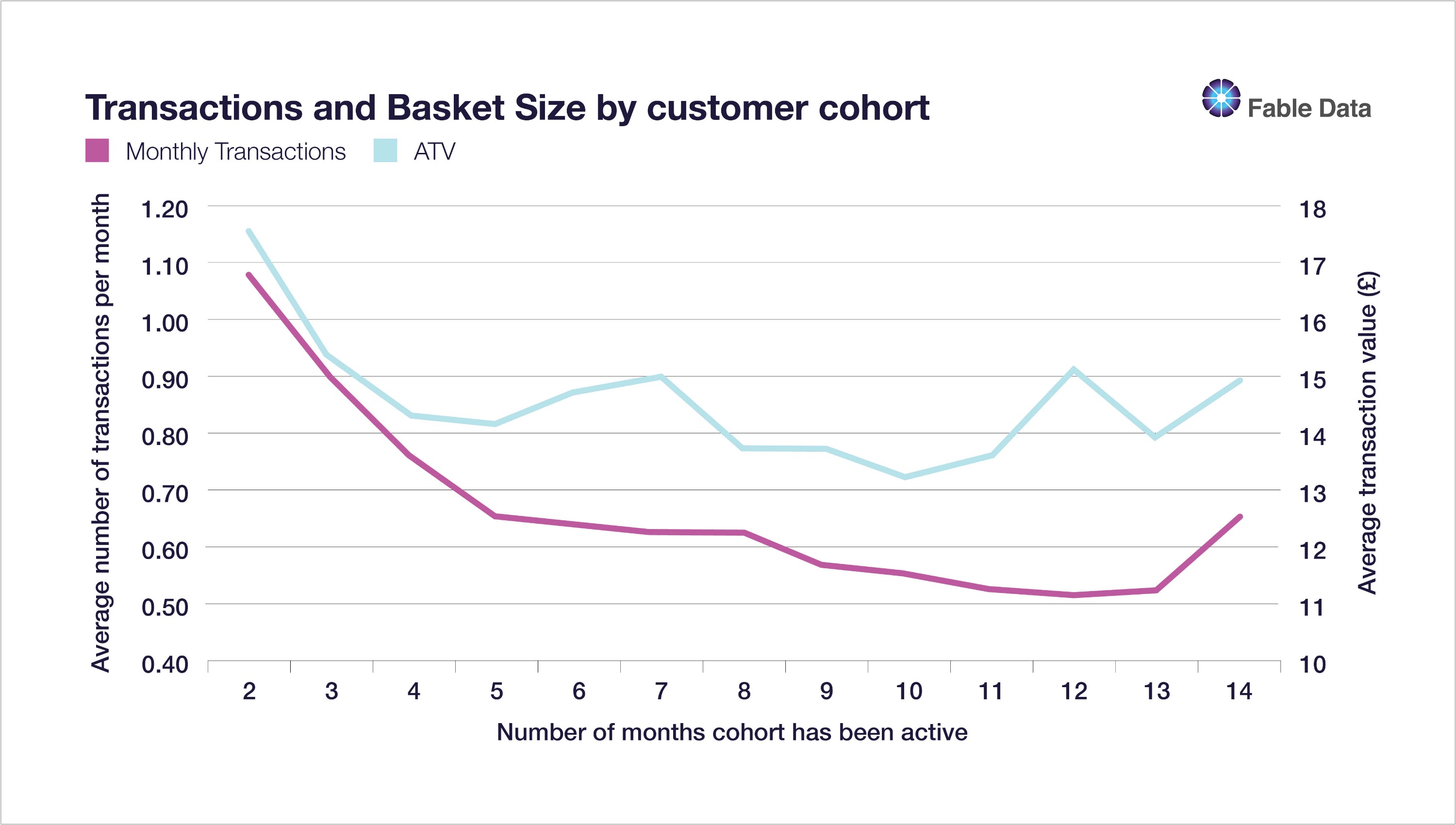

However, more and more customers are trialing Q-Commerce every month and our data indicates that after an initial basket value of c.£17.50, transaction sizes fall back to c.£14.50 as customers become more established, and perhaps the novelty value wears off.

Customer loyalty is also a challenge and turning trialists into loyalists will be critical for the long-term success of these organisations. Fable’s data indicates that after initial engagement levels of 1.6 transactions per month, after five months this reduces to c.0.6 transactions per month.

Whose lunch is Q-Commerce stealing?

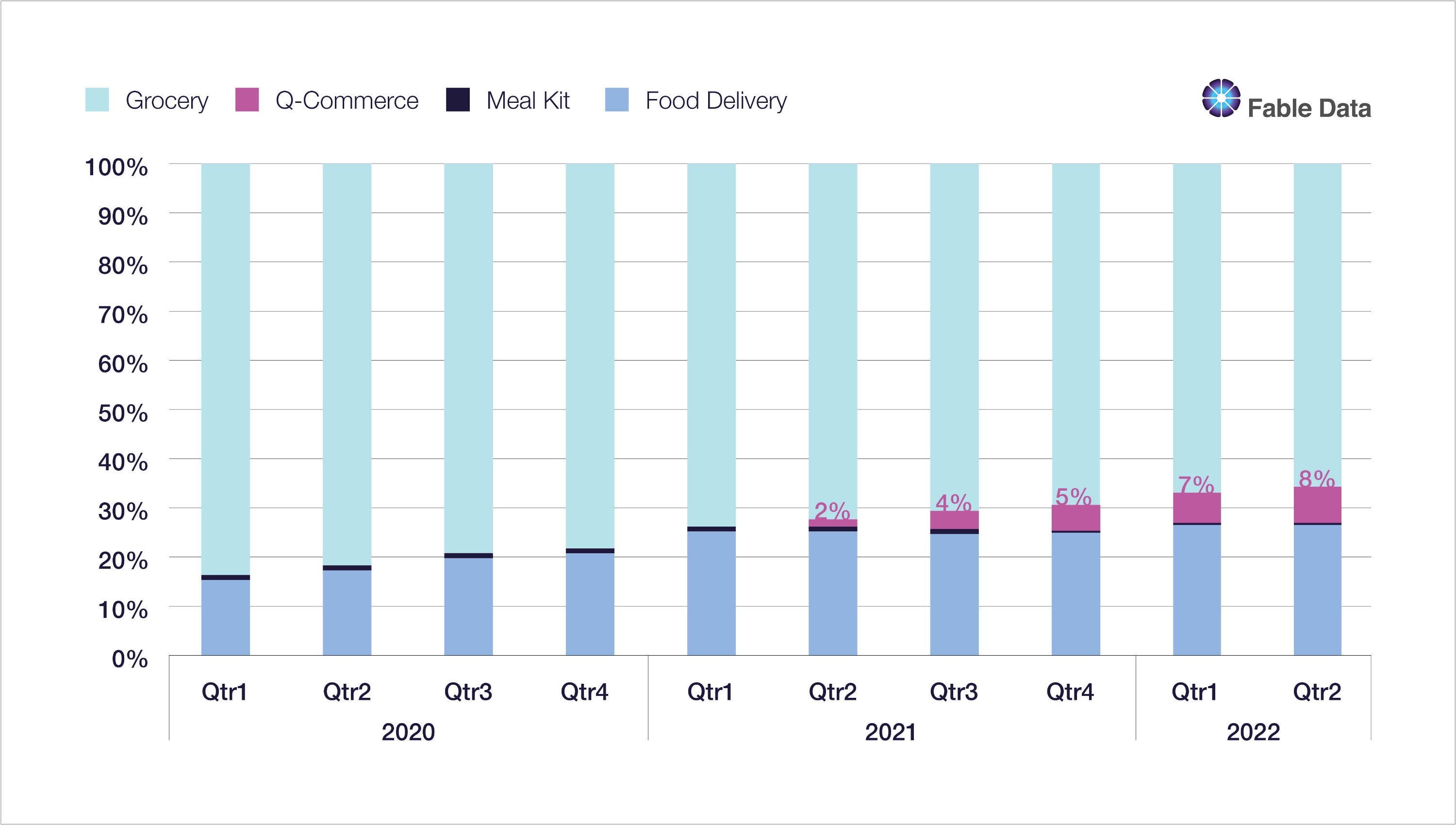

Fable looked across all consumer spending categories to determine winners and losers from the introduction of Q-Commerce in the UK. We used our dataset to explore the impact on grocery, food delivery, and meal kits. At a high level, grocers have taken the largest hit, with their share of spend across these sectors notably declining from 84% in Q1 2020 to 65% in Q2 2022, with Q-Commerce now making up 8% of overall food wallet spend.

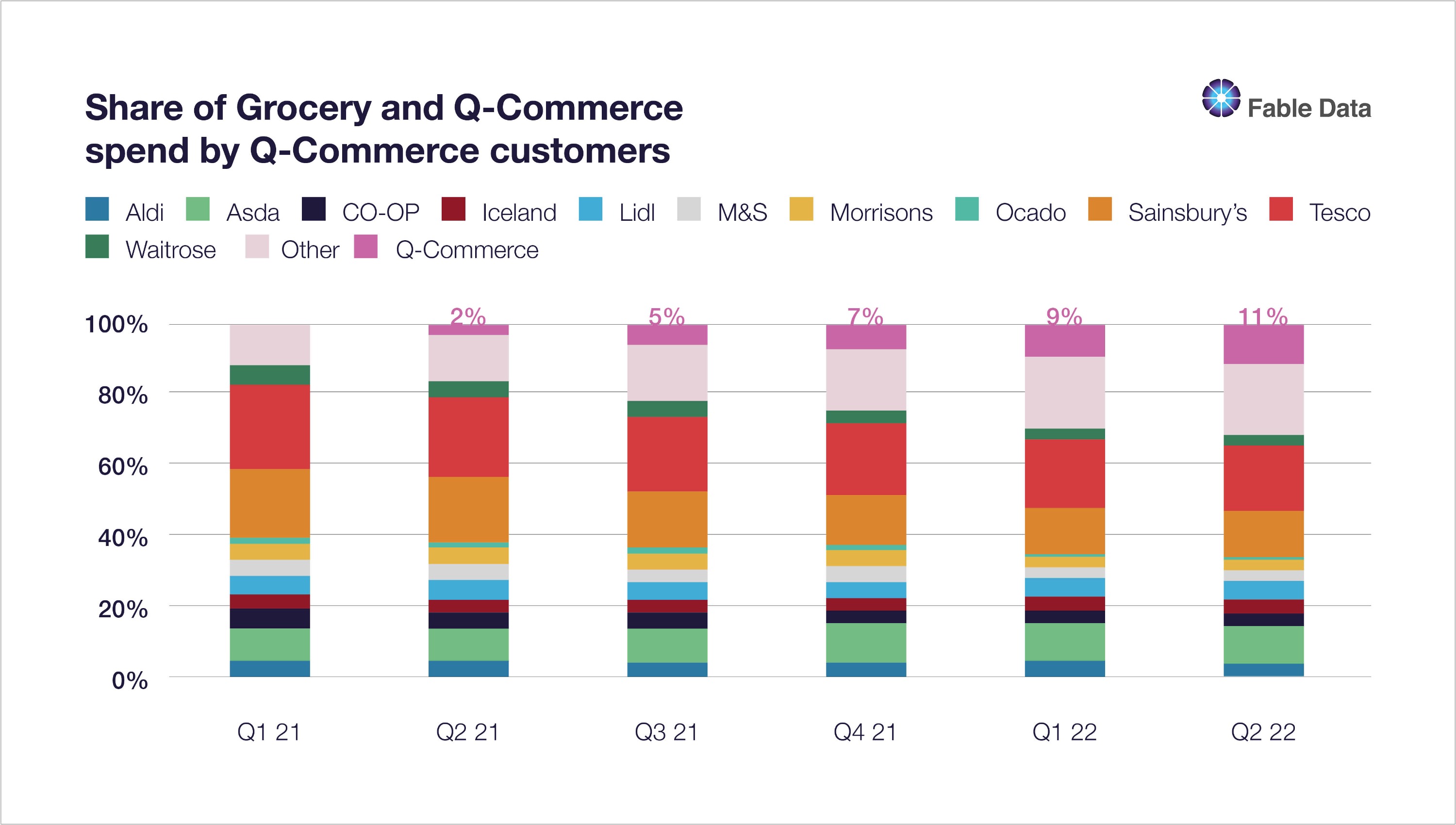

However, not all Grocers have been affected equally. The more affluent, time-pressured Q-Commerce consumers were previously choosing to shop with multiple retailers with large convenience store footprints eg. Tesco and Sainsbury’s, along with the higher-end offers of M&S and Waitrose.

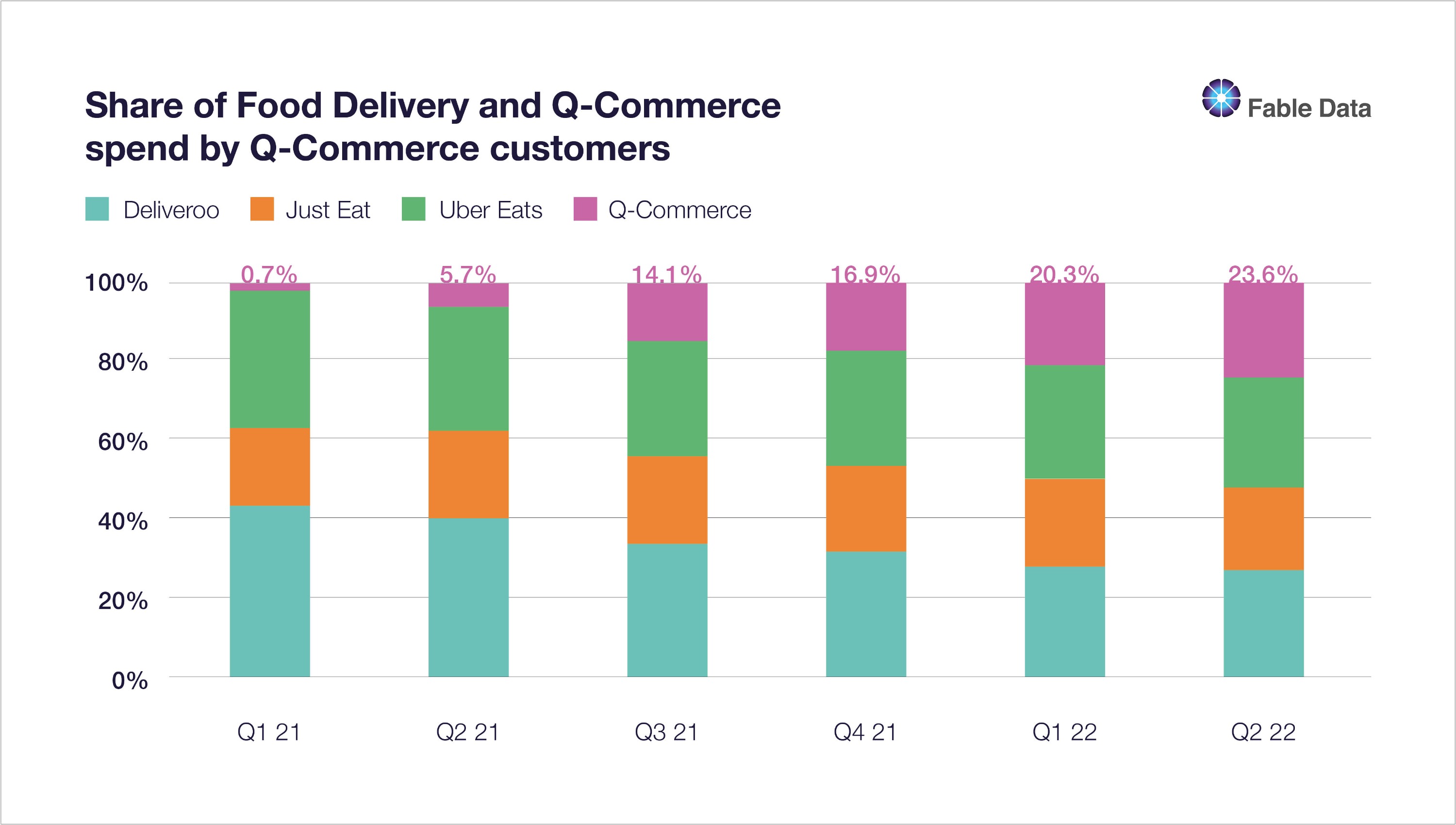

Whilst the main shift in consumer spend to Q-Commerce has come from the Grocery Sector, Food Delivery organisations have not been immune, with both Deliveroo and Uber Eats also being impacted:

What next for this ‘fast food’ sector?

The Q-Commerce category is new and rapidly developing, attracting a younger, more affluent demographic, living in urban areas. However, operators are capturing a low share of the overall customer food wallet, and only enjoying limited customer loyalty. To achieve hyper-growth, organisations will need to focus as much on customer retention programmes as they do on acquisition. Growing basket sizes will also be key, as there is little margin available to cover delivery costs with basket values of under £15.

Whilst small at the moment in the context of overall Grocery, higher-end Grocers will need to develop their own defensive strategies to compete with Q-Commerce. They already have the benefit of store footprints and could easily target Q-Commerce customers by providing a solution at very low incremental cost through either direct from store deliveries (similar to e-commerce), or via partnerships with a ‘last mile’ provider, as has just been announced with Boots partnering with Deliveroo and M&S partnering with Ocado. We shall continue to monitor consumer spending on Q-Commerce to see who prospers and who loses in this latest Grocery sector battle for consumers.

Anthony Graham, COO, Fable Data, Anthony@fabledata.com

About Fable Data

Fable Data is an Award winning pioneer in the European real time consumer transaction data market. We own the most comprehensive anonymised dataset of European banking and credit card data, supplied directly from source and based on millions of European consumers.

In addition to partnering with leading financial providers, Fable has a stellar client base of global Tier 1 Investors and Fortune 500 companies. We also work closely with central banks, institutions, and academics, to ensure that our ground breaking data and analysis are shared, at no cost, with global decision-makers.

Fable’s real-time view of the global economy informs better decision-making in business, government, research, and development.