UK Food Delivery: Our latest insights on whether consumer growth will slow post-lockdown

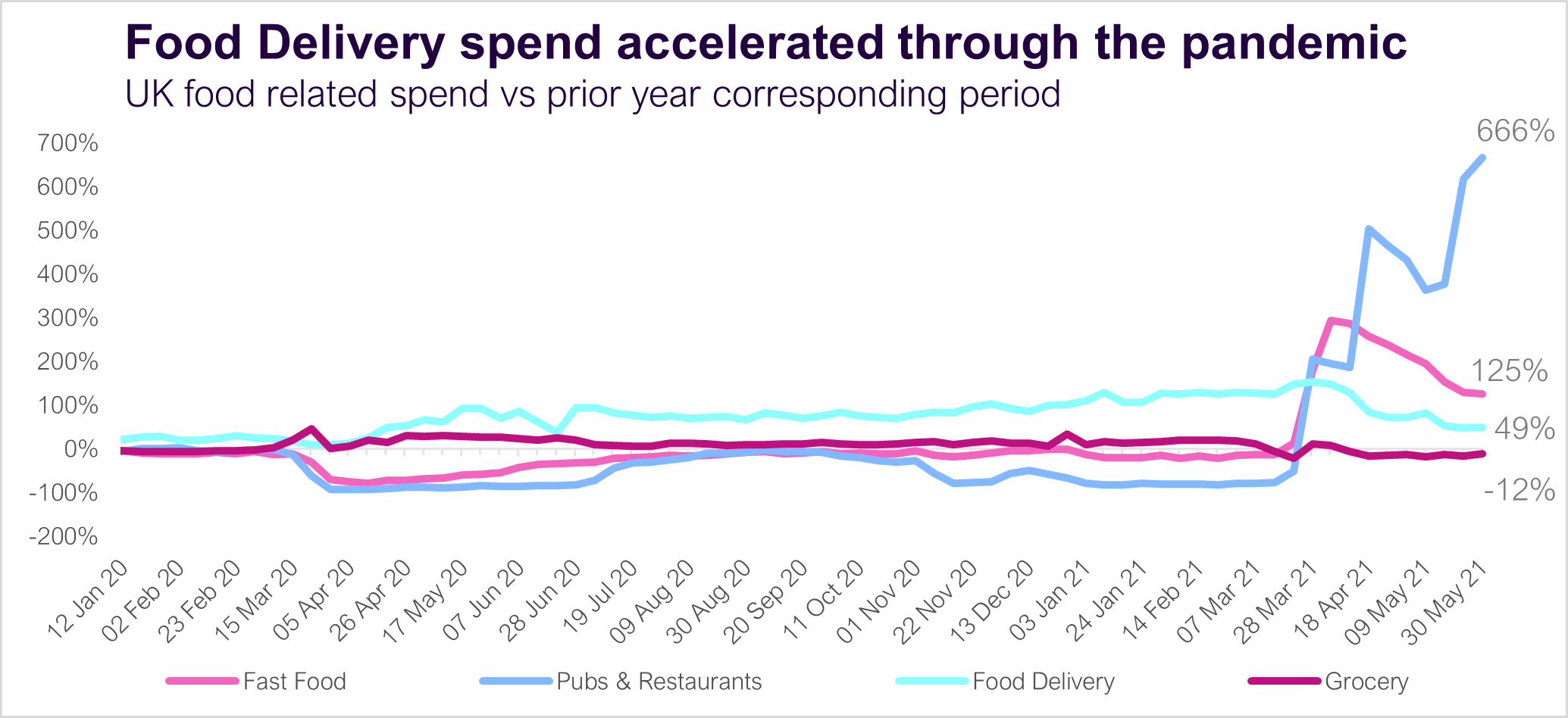

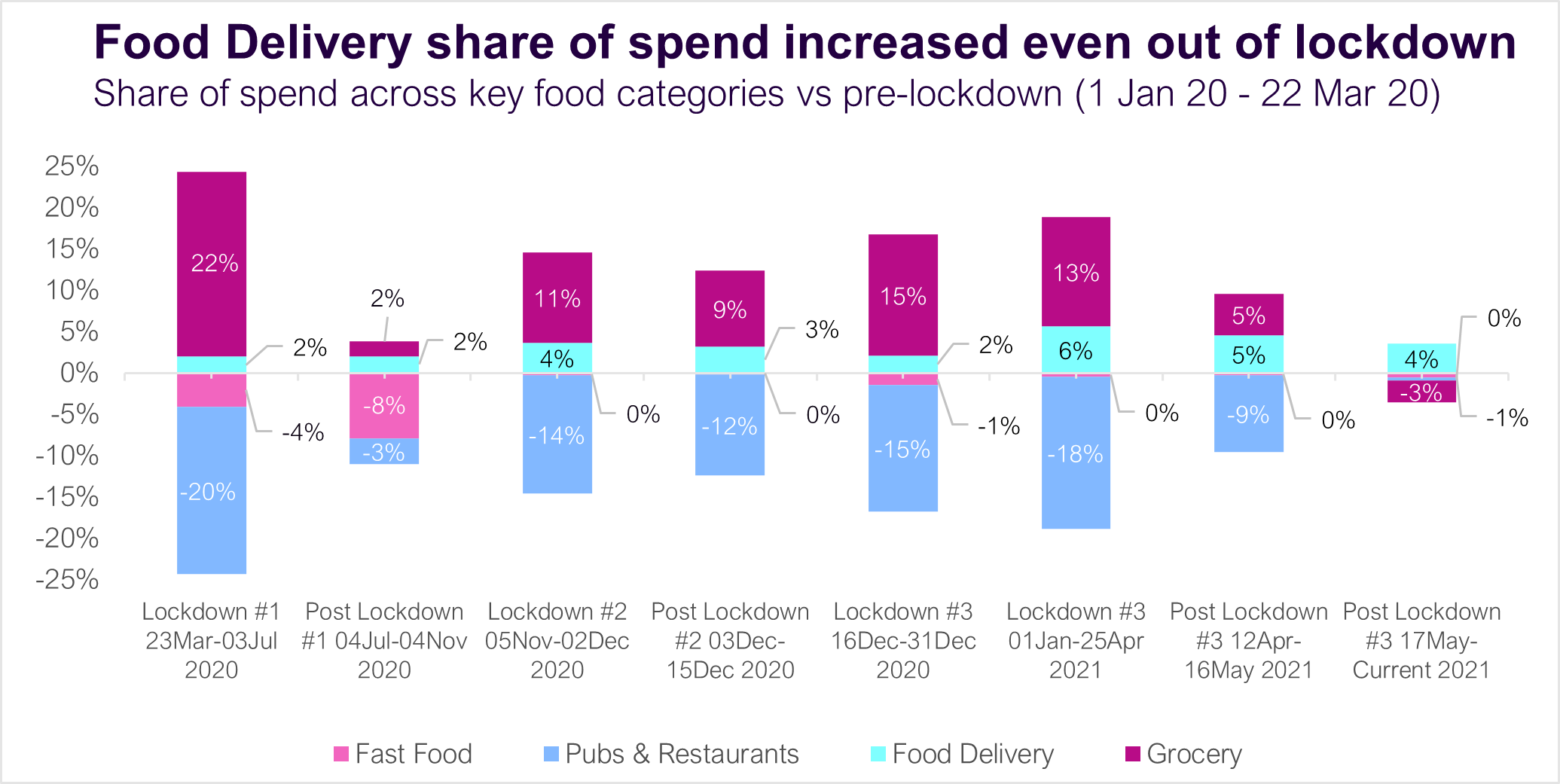

While much of the UK hospitality industry has suffered since lockdowns began in March last year, Food Delivery has seen spend accelerate, along with the Grocery sector.

- Since April 2021, Food Delivery spend remains elevated even post-lockdown and with the opening of pubs and restaurants.

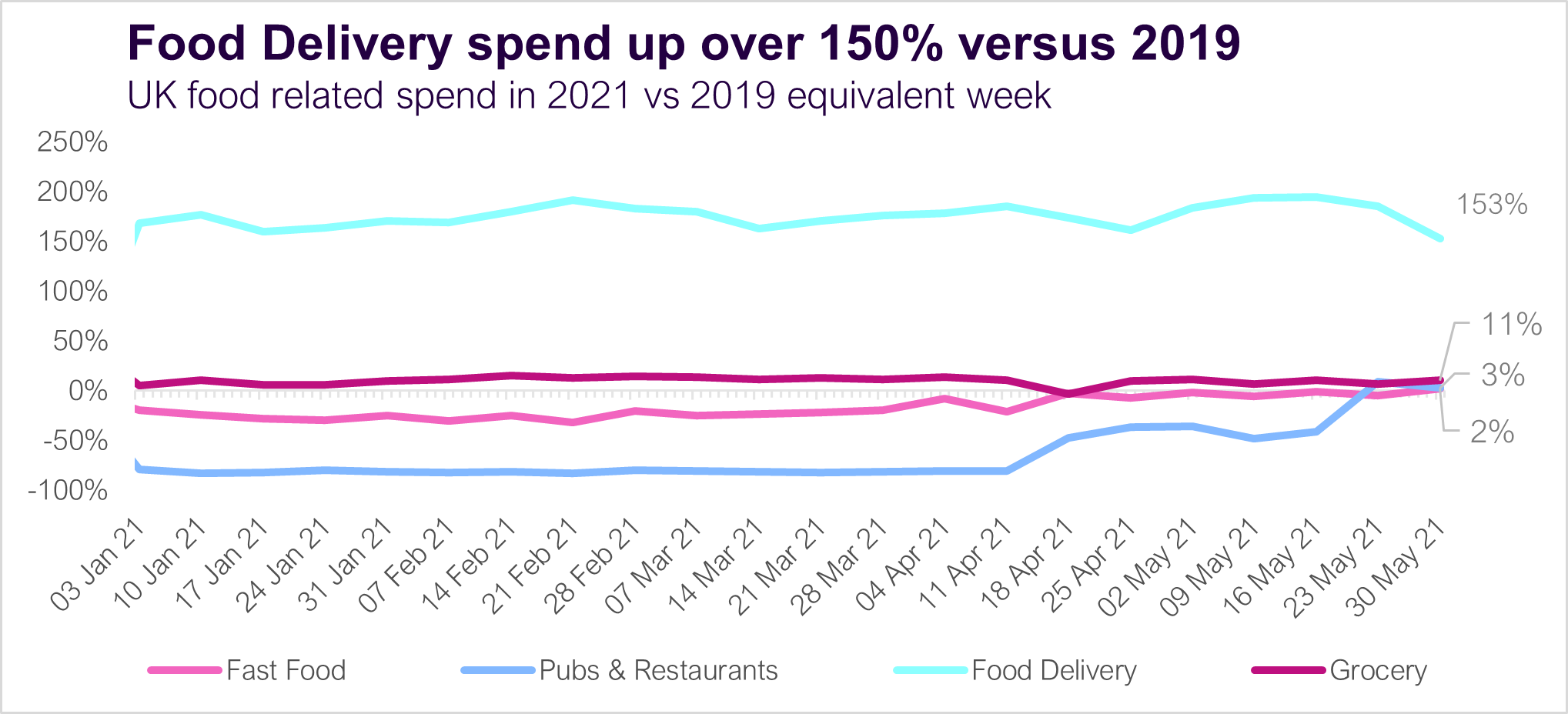

- Food Delivery spend is now up over 150% vs the same week in 2019, and up 49% YoY. Overall share of food wallet has also shown a sustained improvement relative to pre-pandemic levels.

- Increased spend frequency and customer retention are key drivers while order sizes appear to be normalising.

As we start what we hope will be a return to normality, Fable Data asks: how permanent are these new patterns of consumer behaviour? How predictive is the data from the last year? Where do we see industry players holding onto their gains, and where do we anticipate a reversal to pre-pandemic positions?

Unwavering spend growth for Food Delivery, both in and out of lockdowns

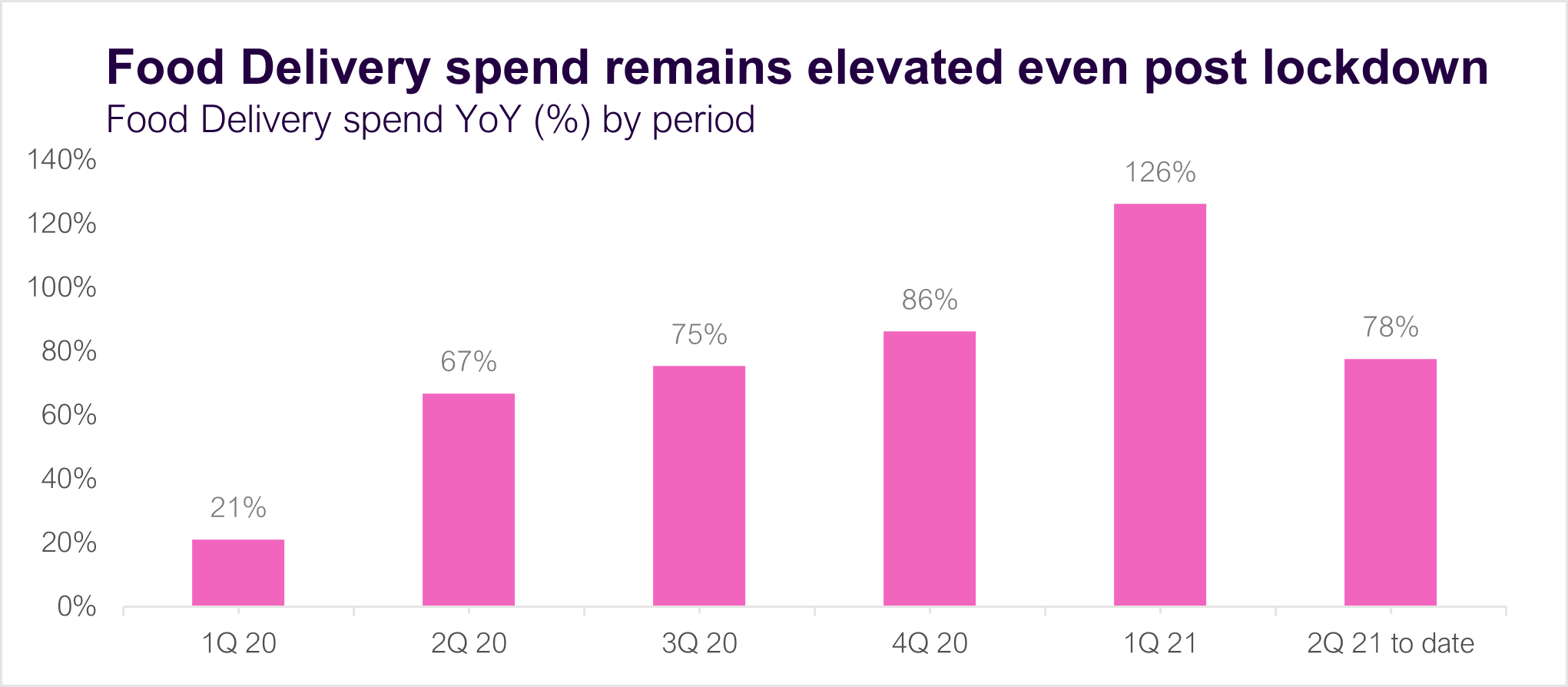

Food Delivery spend was already growing between 20%-30% YoY in the quarters prior to March 2020, when the first lockdown occurred. This accelerated further with the onset of the pandemic, and continued even through the intermittent re-opening of pubs and restaurants between lockdowns.

Although Food Delivery spend growth has dipped slightly in recent weeks, it still remains significantly above pre-pandemic levels. The question over the summer months will be: to what extent is this sustained given the rise of Food Delivery platforms throughout 2020?

The combination of new customers trialling these platforms and increased order growth from existing customers, saw YoY spend growth peak at over 100% YoY over the most recent lockdown period (Dec20 – Apr21), and 126% through the first three months of 2021.

In the seven weeks since 12 April, when UK pubs and restaurants reopened for outdoor dining, Food Delivery spend was up 66% YoY, and up over 178% versus the same period in 2019. Last week it was up 153% vs the equivalent week in 2019.

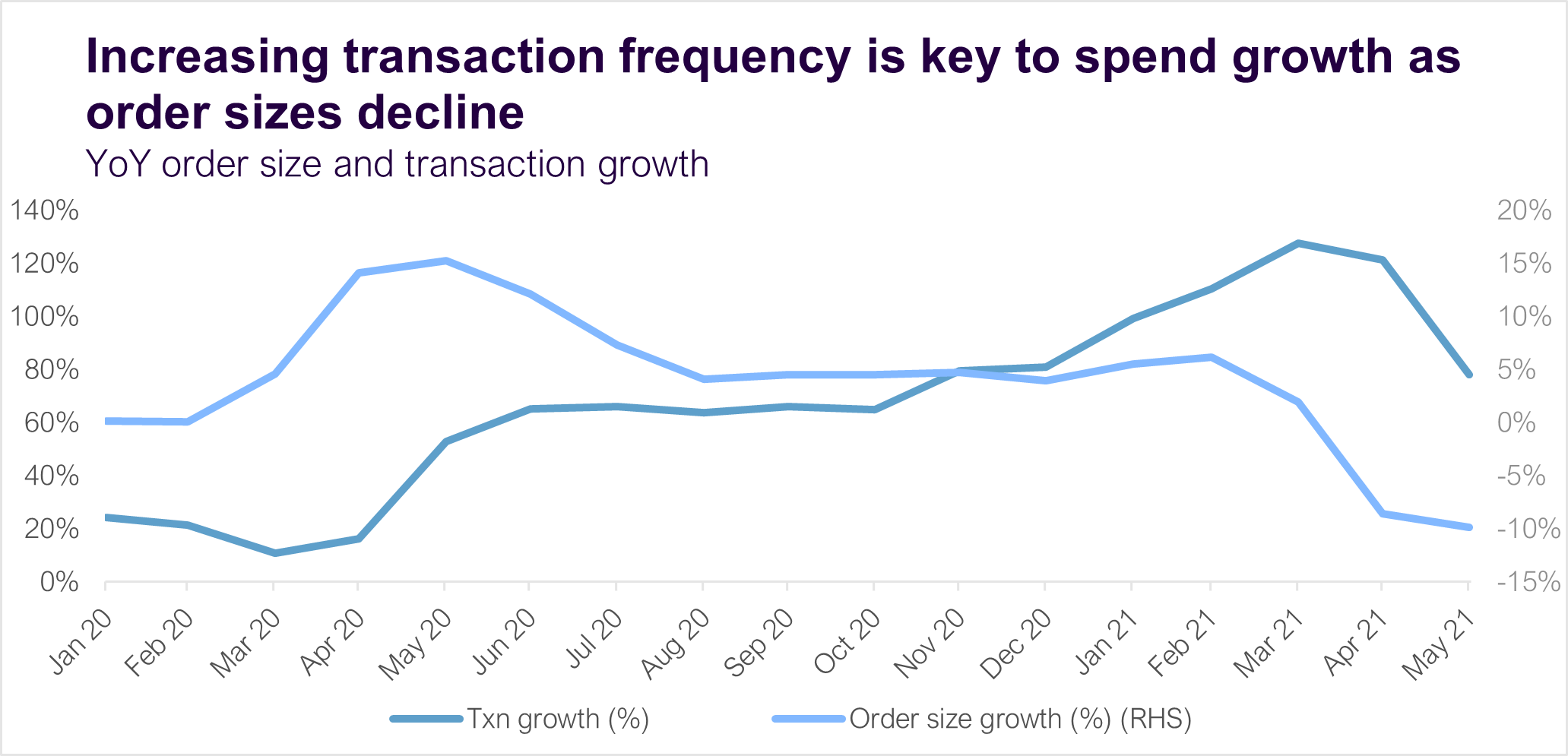

Frequency and retention driving higher spend, despite lower order sizes

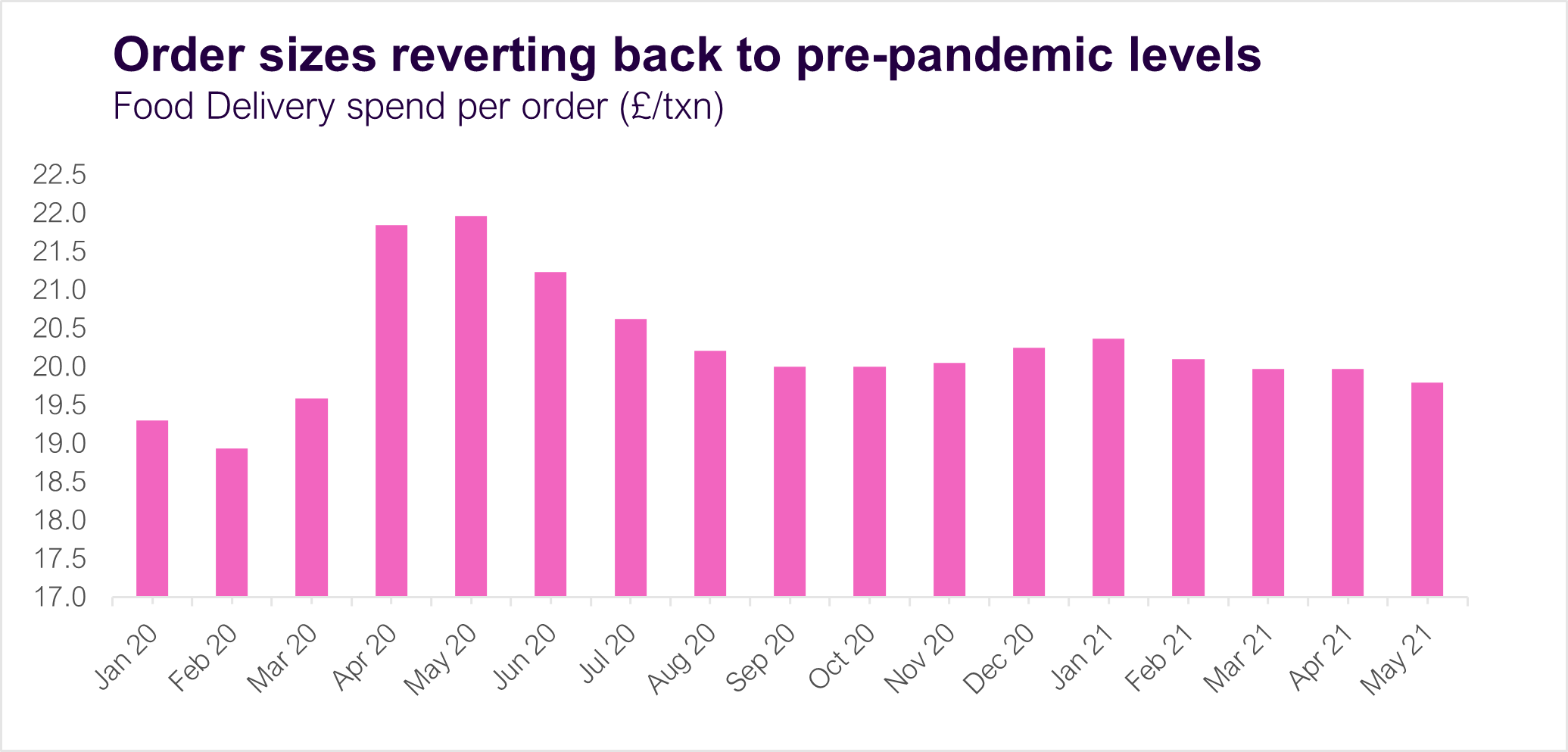

Since reaching a peak in May 2020, order size has decreased. This is likely due to a combination of reasons: a growing number of lower cost options becoming available on food delivery platforms, general increased customer willingness to pay for food to be delivered, customers substituting fast food for other food delivery, and more competition boosted by increased promotional activity, particularly during lockdown periods.

With average order sizes remaining relatively flat over the first quarter of this year versus the same period in 2020, the principal driver of spend growth has been increased transaction (order) frequency and customer retention, although we’re just starting to see some slight declines in transaction growth in recent weeks.

With order sizes reverting back to pre-pandemic levels, and pubs and restaurants reopening, retaining existing customers will become key to food delivery players holding onto their gains.

Food Delivery holding onto gains as the hospitality sector reopens

There are early signs that the extraordinary growth in Food Delivery seen over the last year is continuing. Spend in pubs and restaurants returned to just 35-40% below 2019 levels after the easing of restrictions began and outdoor dining was allowed. With indoor dining resuming since May 17th, pubs and restaurants spend has returned back to 2019 levels, up 6% vs 2019 over the last two weeks. Despite this bounce back, Food Delivery spend continues to track above pre-pandemic levels, with spend over the last two weeks still 170% above 2019 levels and up 48% YoY.

Looking back at 2020, Grocery spend declined when pubs and restaurants reopened. By comparison, Food Delivery spend declines during reopening periods have been much less pronounced, and share of overall food wallet continues to improve and track above pre-pandemic levels.

As the economy continues to recover in the UK, we will look for the early and predictive signs in our data to indicate growth that’s here to stay for some, and returning to pre-pandemic norms for others.

Fable Data helps investors and global corporates to analyse our category data at the individual stock ticker level. For more detail on the company specific data behind these trends, please contact insights@fabledata.com