Micro Data Grocery Analysis – The Day Aldi Came to Town

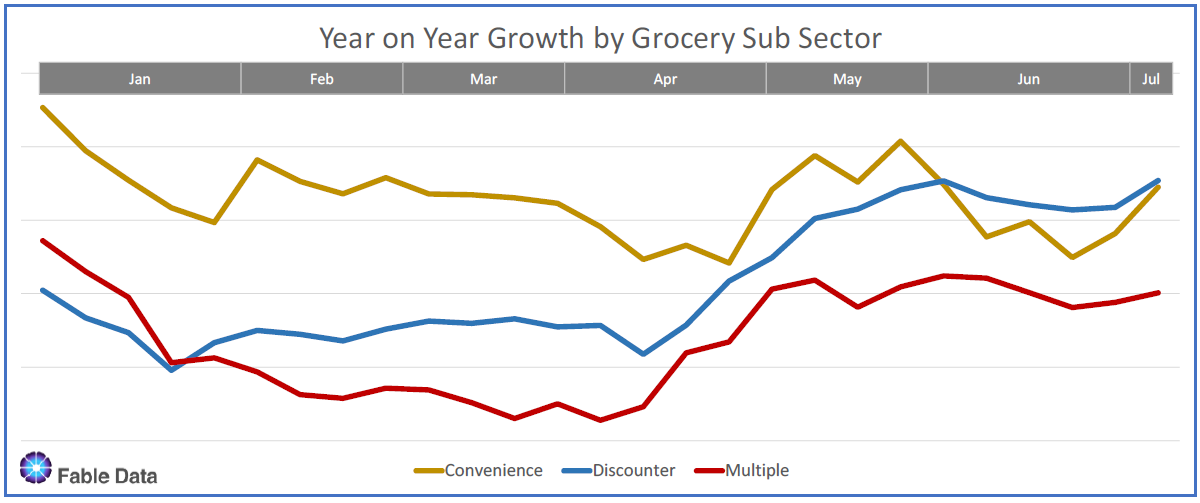

The current cost of living crisis has seen a significant shift in consumer spending patterns as household budgets have been increasingly squeezed. The Grocery sector traditionally acts as a reliable barometer for the wider economy, so it’s perhaps unsurprising that since April, there has been a noticeable shift in consumer spend towards Discounters – Aldi, Lidl and Iceland. This has occurred at the expense of the large Multiples, and Sainsbury’s, Waitrose and Morrisons are particularly feeling the pinch, as shown in the graph below.

So, how reliable is the National macro experience when determining behaviours and

predicting outcomes?

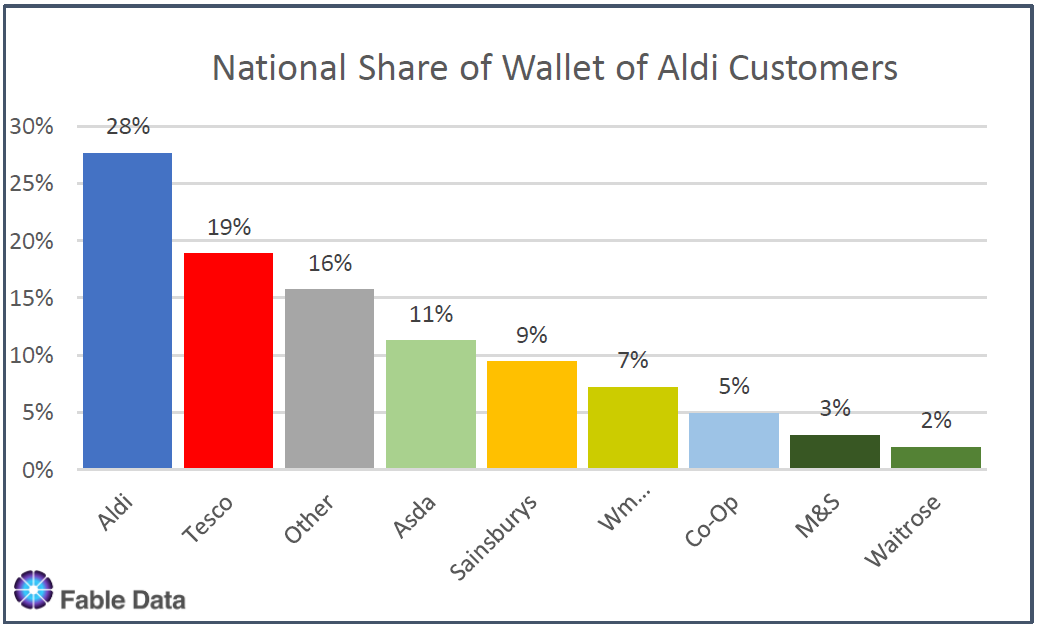

Through Fable’s extensive real time consumer transaction data and analysis, we could see that at a national level, Aldi customers also like to shop with Tesco compared to other grocery outlets, as shown here.

So, based on this, it wouldn’t be unreasonable to assume that if Aldi were to open a new store in the vicinity of a Tesco, the natural result might be that Tesco would lose market share, as Aldi muscles in luring customers away. However, the truth couldn’t be more different when we move to a micro case study of what actually happened when Aldi opened a store in St Albans, Hertfordshire in January last year.

St Albans, Case Study

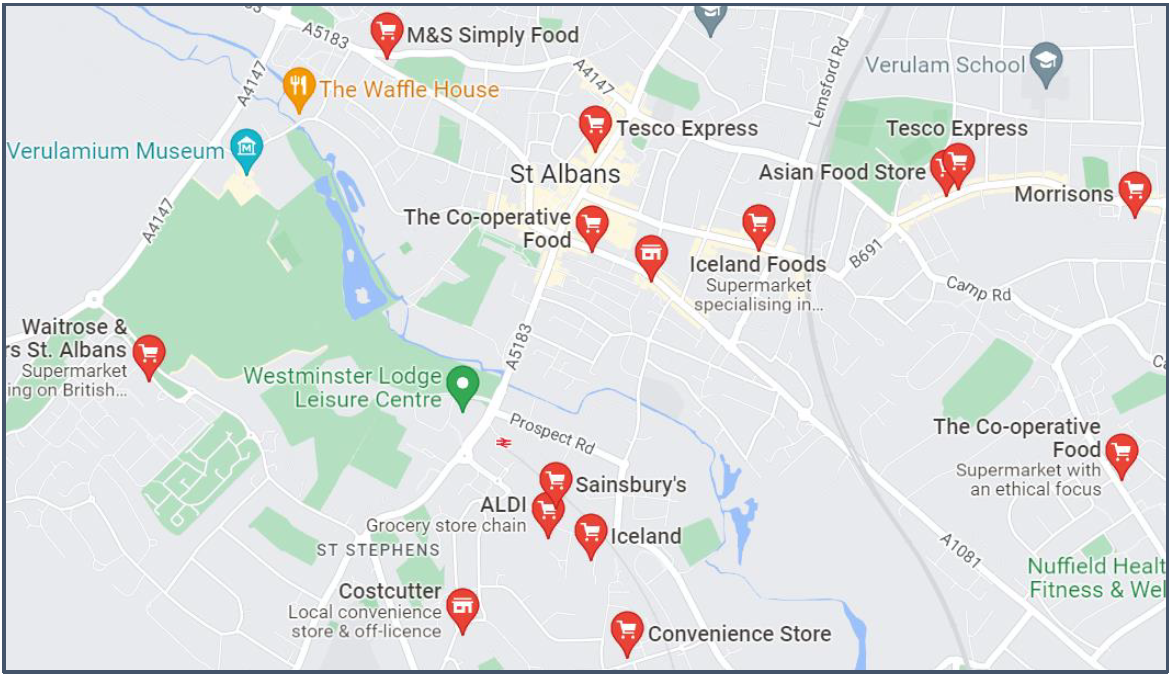

The new Aldi store was based in the Abbey View Retail Park and the closest competitor was a Sainsbury’s superstore, 0.4 miles away by car. Within a 2-mile radius of the new Aldi store, there were also five major grocery chains and a host of convenience and specialist Grocers.

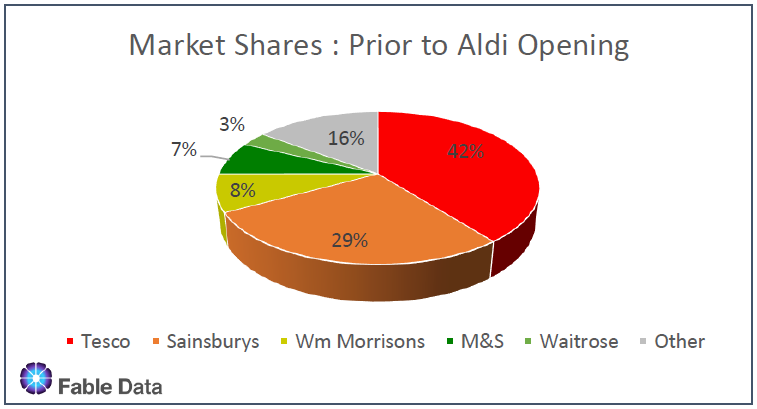

Market share was dominated by Tesco at 42% and Sainsbury’s at 29%.

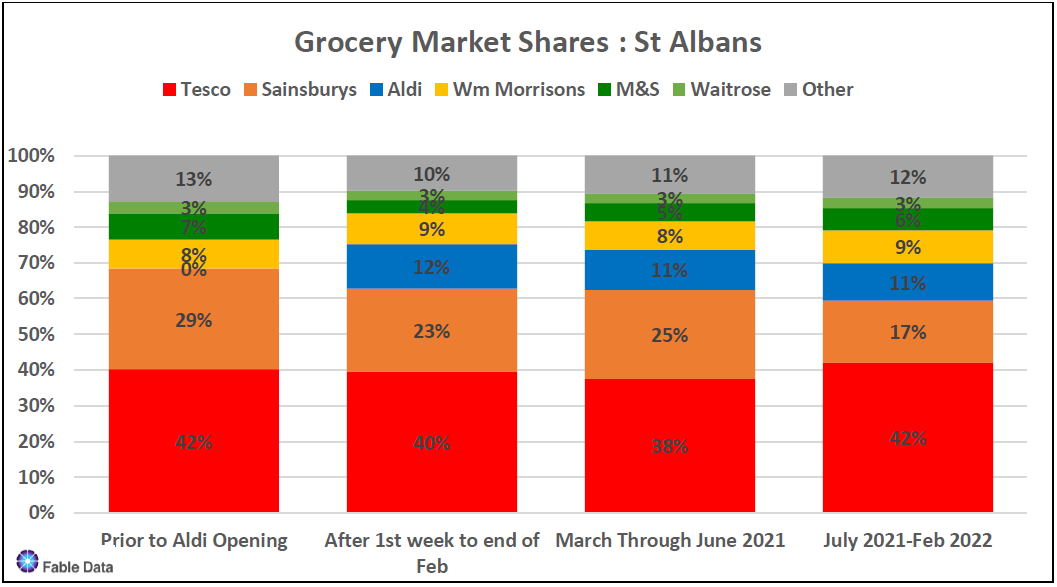

Tracking actual customer spend from Fable’s data universe of local consumers, the impact of the new Aldi store on St Albans Grocery spend has been tracked over time to understand

a) the immediate impact and b) how this settled over the following year.

Outcome

After 12 months, Aldi had secured an 11% share of the local market spend in St Albans, which was largely taken from neighbouring stores Sainsbury’s, Iceland and some independents. However, the share of Tesco, Morrisons, M&S and Waitrose was largely unaffected by Aldi’s arrival, (as shown below).

This suggests that shoppers simply switched between convenient neighbouring outlets and that brand loyalties were low on the agenda. Without this knowledge, it might have been tempting for Tesco to fight back with promotions and campaigns, without realising that this would be money wasted and would have little longer term impact, as convenience was the major dynamic at play and not prices.

However, Sainsbury’s could have recognised the danger of losing market share within a small geographical area ahead of time, and could have taken appropriate steps to attempt to minimise the fall in spending in their outlet.

Conclusions

I’m reminded of one of the early lessons I learned in retail, “every store, every day”. At a macro level, it is easy to draw conclusions that price sensitive discount customers are most likely to switch from the more value-based grocers. However, the story at the micro level can be very different and by really understanding local dynamics, retailers have the opportunity to become far more astute and targeted in their sales activities, thereby defending market share and maintaining customer loyalty.

Whilst historically, it was impossible to track near real time consumer movements, the advent of anonymised transaction data using the documented spending of millions of consumers, across billions of rows of data, enables Fable to empower retailers to develop deep local insights to inform both strategic Capex investments and tactical local marketing activities.

About Fable Data

Fable Data is an Award winning pioneer in the European consumer transaction data market. We own the most comprehensive anonymised dataset of European real time banking and credit card data, supplied directly from source and based on millions of European consumers. We supply detailed performance metrics at an individual merchant level and across business sectors – enabling merchants to actively benchmark competitor performance, locally and nationally. We also work closely with central banks, institutions, and academics, to ensure that our ground breaking data and analysis is shared, at no cost, with global decision makers.

Anthony Graham, COO, Fable Data, Anthony@fabledata.com