Netflix ‘ad-ding’ more plans to the mix

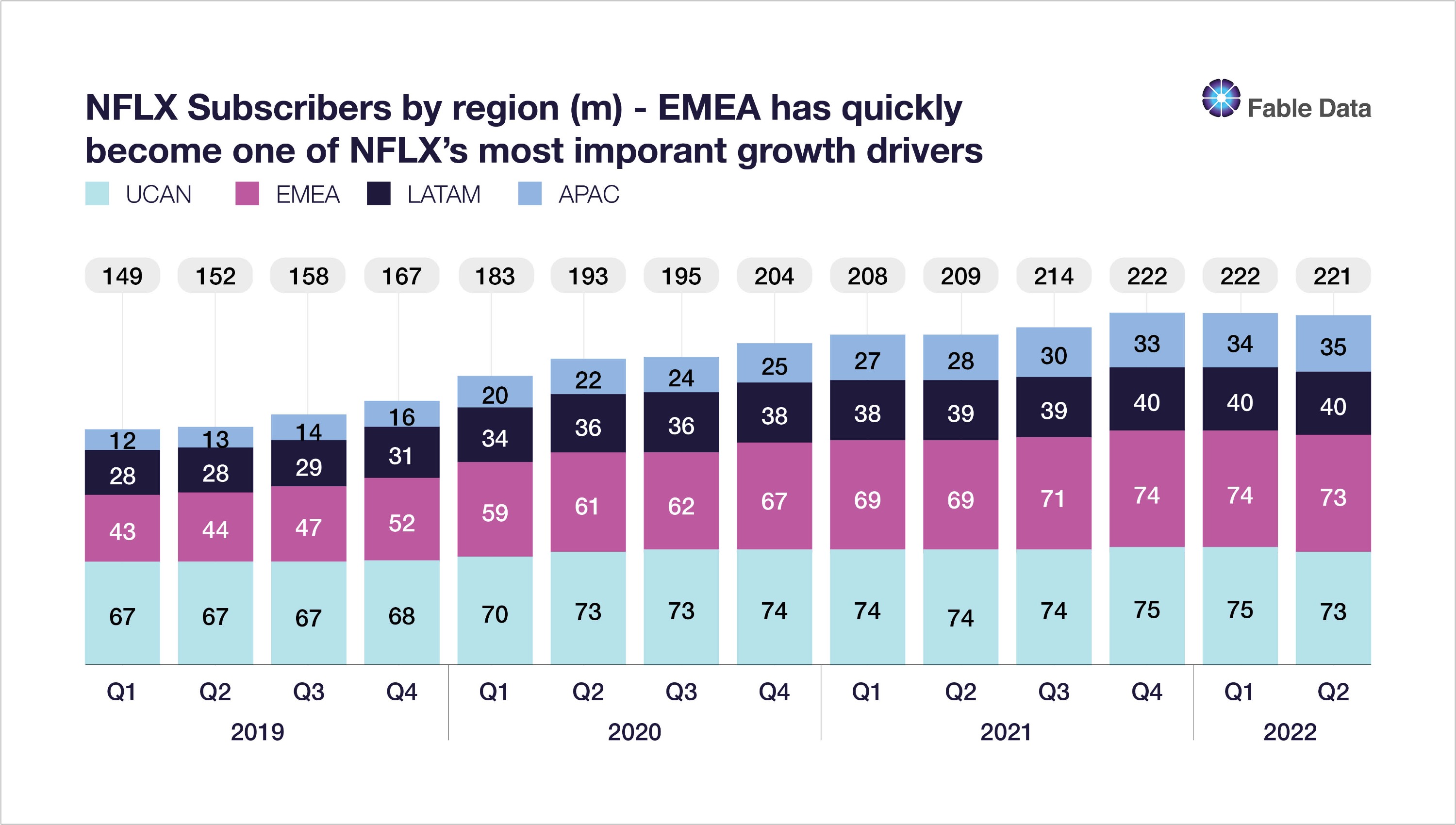

Netflix is poised to fundamentally change its offering with the reported release of a cheaper ad-supported subscription offering in select countries across its 220 million plus subscriber base. The potential for an ad-tiered offering has been muted for some time and it should be said that Netflix is not the only large streaming business considering this option. However, the timing pencilled for late 2022 is particularly interesting as Netflix looks to its next wave of growth as it navigates its way through a murky and uncertain economic environment and cost of living crisis.

Adding to these woes are Netflix’s own headwinds including slowing subscriber growth in more mature markets, increasing competition, the strengthening Dollar and the lack of pandemic-driven growth tailwinds enjoyed in 2020 and 2021. With many of the headwinds unlikely to offer a reprieve for some time, the impact and underlying success of the new offering will be a key focus for investors in 2023.

Observing Netflix’s fast changing, real time consumer trends in EMEA will be crucial as a barometer for Netflix performance

Over the last few years, Netflix has experienced a surge in EMEA subscribers, with the region now equalling the size of its US and Canadian market. Fable’s pan-European dataset is perfectly positioned to quickly observe and report on signs of changing consumer behaviours, some of which we explore below.

Recent price rises tell the story of a more cost conscious consumer…

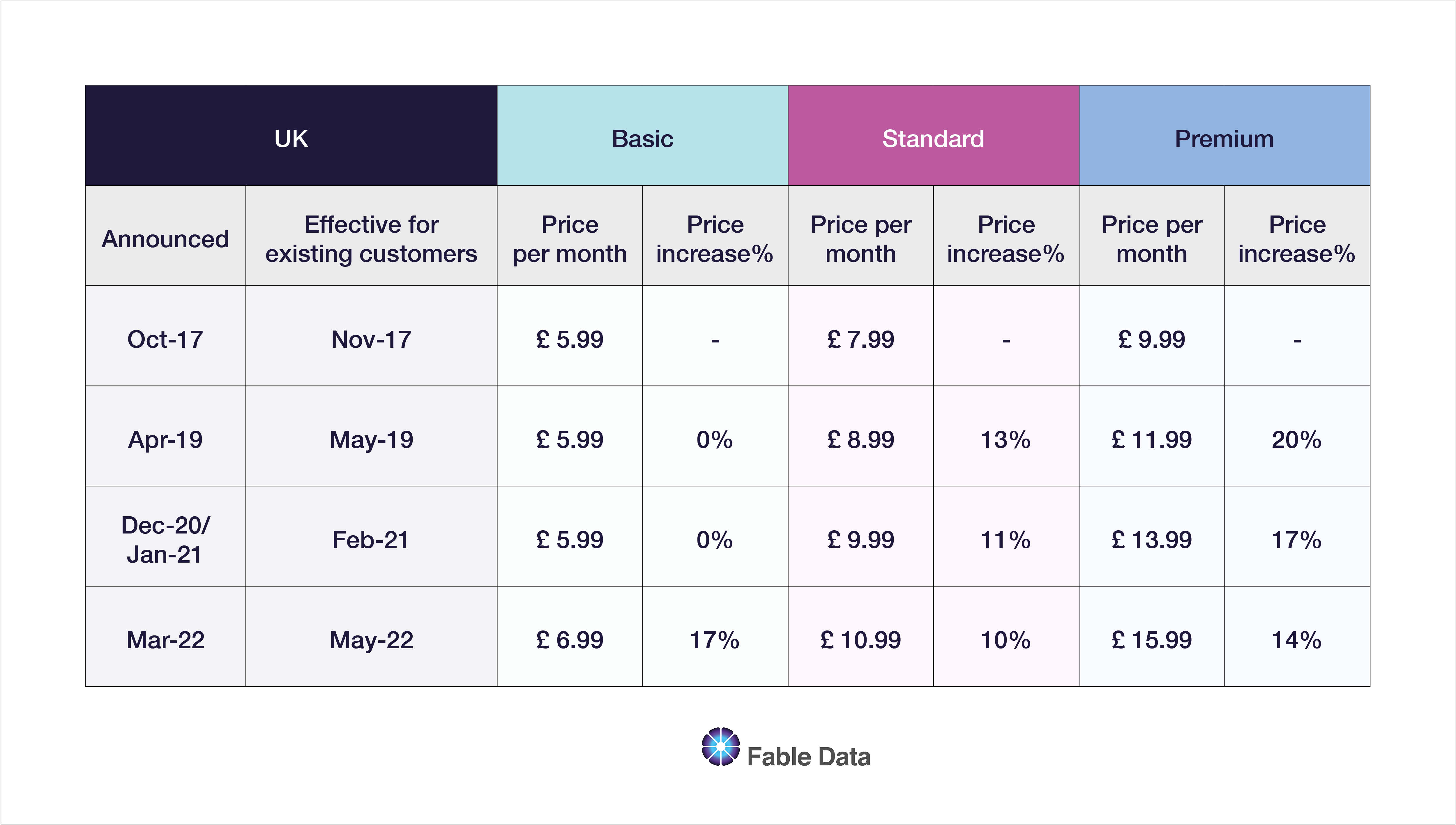

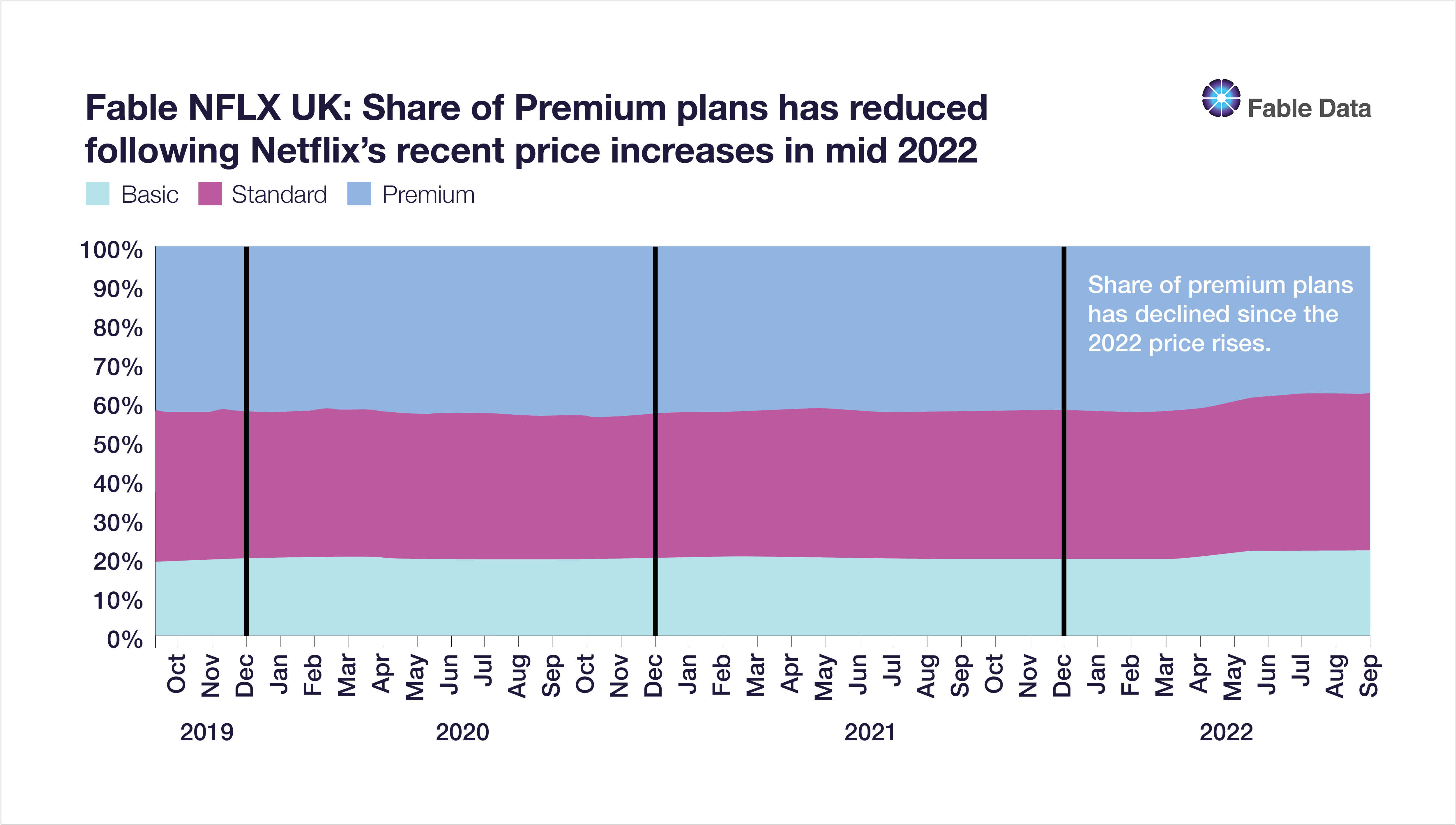

Netflix has raised its prices across the UK and Germany numerous times since 2017, usually justified through significant investment in growing content. For the most part, Fable Data indicates that price rises have been pushed through to consumers with relative ease with few signs of decline in metrics such as retention and subscriber growth or any material indications of consumers downgrading their plans to lower tier options. To date, this has been a true testament of an enviable, satisfied and loyal subscriber base. However, the most recent price rises in the UK are starting to flag a slightly different story….

Is the UK Netflix brand bubble finally bursting? Are there signs consumers are starting to reconsider their spending on streaming services?

In mid-2022 Netflix began to raise the price of its plans for both new and existing customers in the UK by between 10-17%. The Basic plan of £5.99 increased for the first time in almost 5 years to £6.99 (up 17%), while the most popular Standard plan increased by 10% to £10.99 (from £9.99) and the Premium plan increased by 14% to £15.99 (from £13.99).

Through price rises in 2019 and early 2021, Fable has recorded minimal change in the overall share of tiered plans (Basic, Standard, Premium). However, following the recent increase in mid-2022, we have seen the share of Premium plans finally reduce. While there could be various reasons for this, not least of which would be signs of consumers tightening their wallets (both downgrading plans and selecting cheaper options for new subscribers), it should also be remembered that Netflix is coming off a period of record pandemic subscriber growth.

Between the months of April and June 2022 which followed the announcement of an increase in prices, Premium subscriptions declined by ~14%. Approximately ~20% of the decline reflected consumers switching to lower priced plans, while the remaining 80% reflected a cancellation of subscriptions. Somewhat offsetting this decline was an increase in basic plan subscriptions.

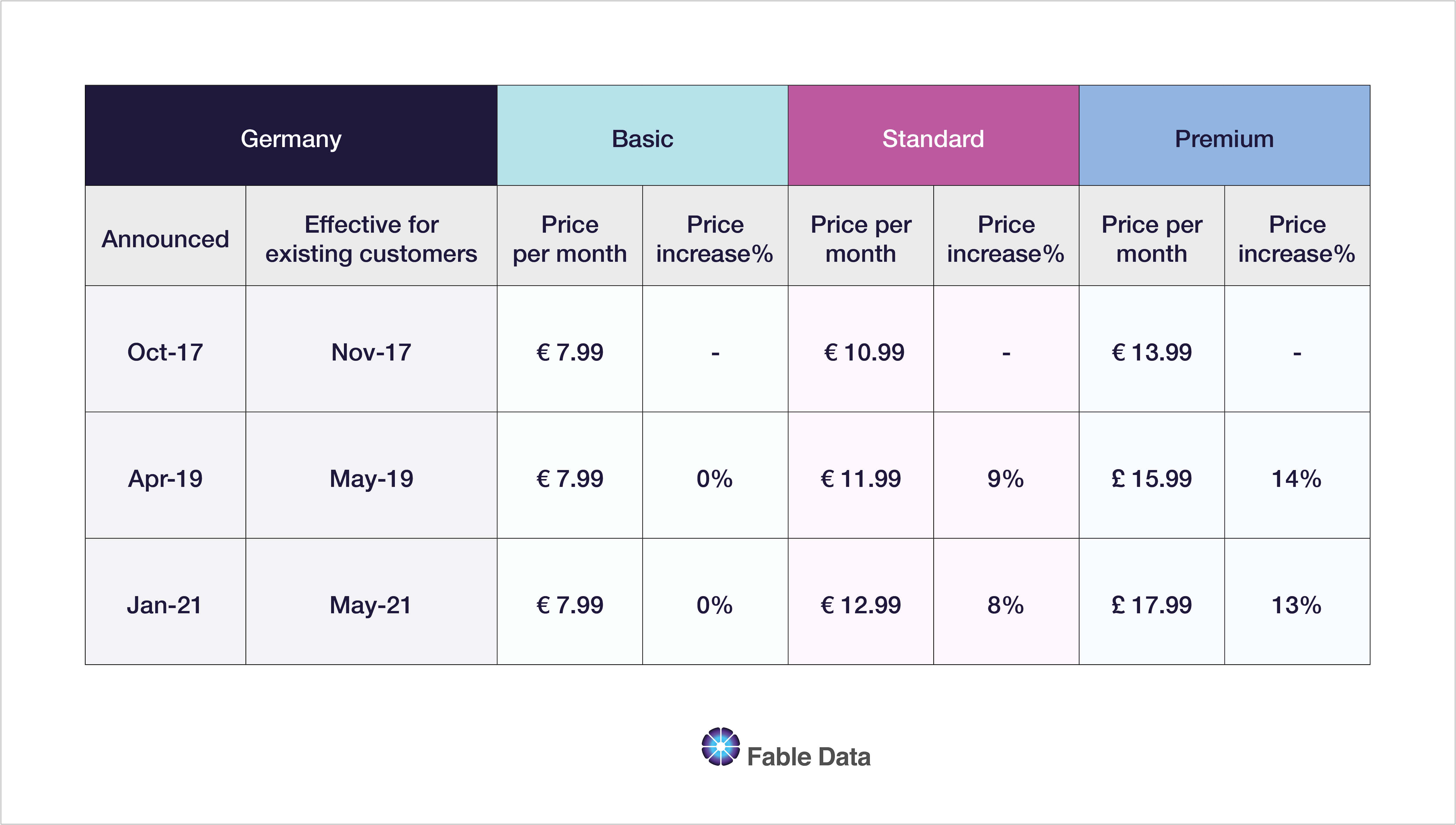

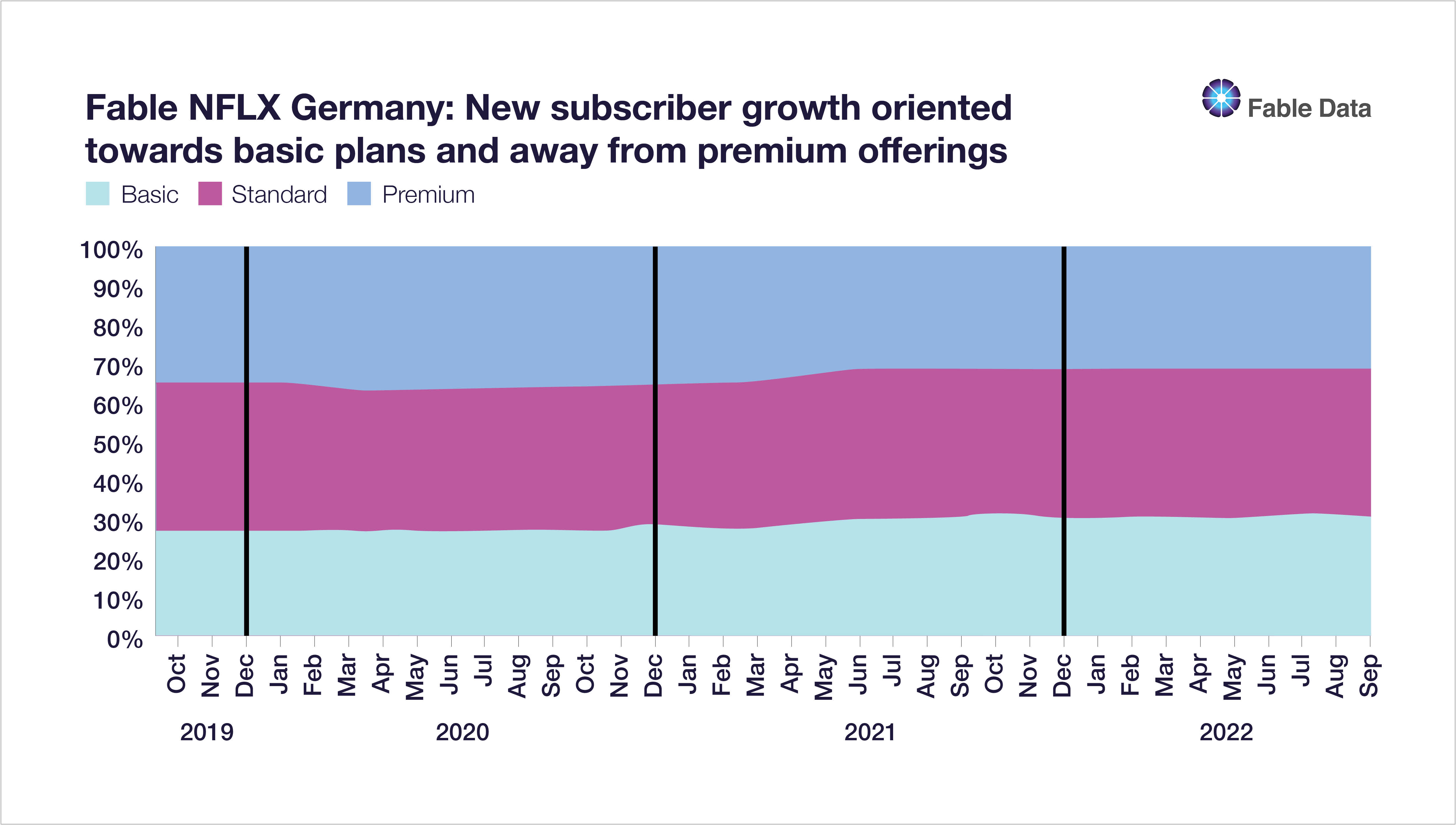

Comparing the UK experience to German consumer behaviours

In Germany, Netflix had planned to introduce similar price rises to those of the UK and the rest of Europe. However, a 2022 ruling by the Berlin Regional Court stated Netflix’s price adjustment clause was invalid, and this has meant prices have remained unchanged thus far in 2022. Despite this, we have seen subscriber growth more weighted towards both Basic and Standard tier plans, albeit it is not as pronounced as the trend seen in the UK following recent price rises.

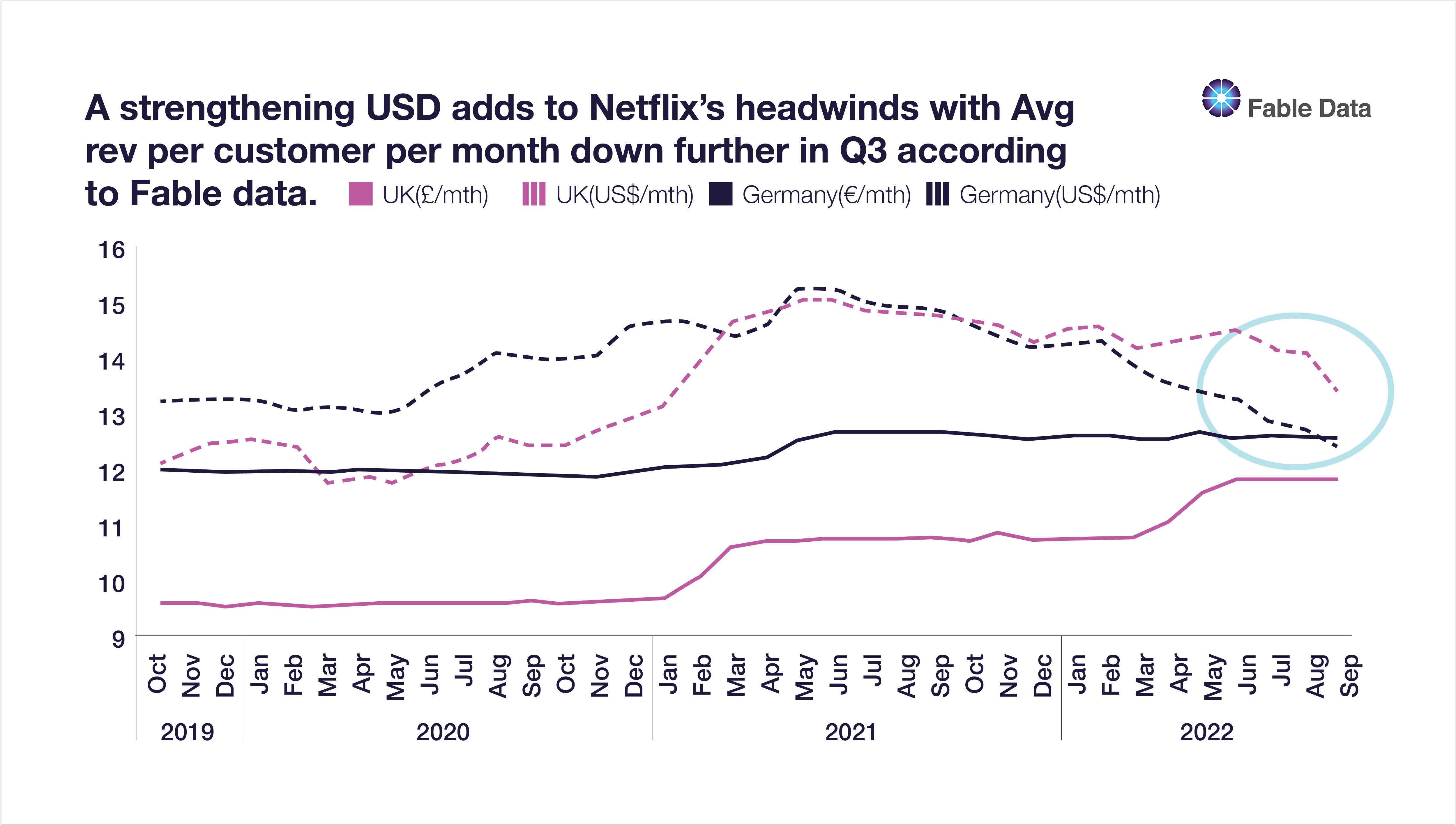

So, what impact has these price and subscriber changes had on realised revenue per customer?

One of the most tracked metrics for Netflix along with subscriber growth is the average revenue per customer (per month). With subscriber growth beginning to slow, this metric is of particular focus in Netflix’s more developed markets.

As we have outlined above, the current economic environment is clearly presenting some challenges for both consumers, and Netflix, with some subscribers increasingly contemplating the option of cheaper plans. Adding to the pain for Netflix however, is the strengthening USD which is seeing realised prices across EMEA significantly decline as seen through the first half of 2022 in UK and Germany.

Fable’s data which has shown a >90% correlation with reported price changes across EMEA, indicates that despite the recent price rises, during Q3 the strengthening USD has contributed to a further decline of 3% and 6% in the UK and Germany respectively when compared to Q2 ’22 average prices.

What does all this mean going forward for the new ad-supported platform?

Details of the new ad-based tier offering are beginning to emerge with a suggested price point of £4.99 per month in the UK, which is 29% below the current basic offering price. How much take up the new offering will have is likely to remain the key question on the minds of many as it will be a key indicator of how sustainable this new revenue stream will be for Netflix going forward.

Given the increasing price elasticity of consumers in the current environment, one school of thought is that the introduction of a cheaper ad-tiered plan is timely as it brings an opportunity for Netflix to remain engaged with consumers that they might otherwise be at risk of losing. Netflix will also be hoping to attract new customers at a lower price point, however, this may prove difficult in more mature markets. On the other hand, the introduction of a lower priced plan could be a catalyst for customer switching or downgrading which could begin to undermine the value proposition of higher priced plans. This may put additional pressure on new advertising revenue streams which are yet to be tested in order to drive incremental revenue growth, as the average revenue per customer would be likely to continue to track lower.

In our view how much appetite consumers have as well as the unit economics and sustainability of the new offering will arguably shape the need for further price rises. Our data shows that this previously successful model is latterly becoming increasingly difficult to adopt.

As consumers continue to endure cost of living pressures, Netflix is just one of many consumer facing businesses likely to face an uncertain outlook in 2023. At an aggregate level, Fable Data has not indicated any material reductions in consumer spending to date, however we are beginning to see signs in some categories of slowing growth YoY [https://www.fabledata.com/reports]. With many factors associated with the macro uncertainty discussed above unlikely to provide any relief in the short term, Fable Data will be closely observing any changes in consumer behaviour across its dataset as many other consumer facing businesses are likely to face similar challenges in 2023.

Avinash Srinivasan, Fundamental Equity Analyst, Fable Data, avinash@fabledata.com

About Fable Data

Fable Data is an Award winning pioneer in the European real time consumer transaction data market. We own the most comprehensive anonymised dataset of European banking and credit card data, supplied directly from source and based on millions of European consumers. In addition to partnering with leading financial providers, Fable has a stellar client base of global Tier 1 Investors and Fortune 500 companies. We also work closely with central banks, institutions, and academics, to ensure that our ground breaking data and analysis is shared, at no cost, with global decision-makers.

Fable’s real-time view of the global economy informs better decision-making in business, government, research, and development.