Will Covid-19 kill cash?

For the past ten weeks, Fable Data has released a weekly trends report, using our consumer transaction dataset to help shed light on the dramatic fluctuations felt by the markets at this time. Obviously, the primary driver of year on year changes has been the Covid-19 pandemic lockdown – “Stay at home”, and later the partial ease – “Stay Alert”. This newsletter highlights the macro changes in consumer spend and the more granular category-level differences. Travel-focused categories saw spend reduce to less than 5% of their 2019 values, whereas online sales of food, general merchandise and alcohol soared. In addition to Merchant Category Code (ie clothing) level tags, the Fable Panel data is tagged to over 1,500 merchants including ASOS, Audible and Airbnb.

There are many other attributes in the underlying dataset which are worth investigating. A valuable feature for both our corporate and investment clients is the payment provider on the transaction. Trends on payment providers are useful to guide on the performance of the provider, but also on macro trends in consumer behaviour and the economy.

The last few years have seen many new entrants to the card handling, payments processing and fintech market. Ten years ago, if you did not use your bank card, PayPal was almost the only game in town.

The Fable Data Panel is an aggregate of millions of consumer transactions with descriptions that you would be familiar with from looking at an online credit card statement such as

“Tesco Stores 3056 £20.00”. Some transaction string patterns contain information on both the merchant and the payment provider, for example:

CRV* UBER EATS

IZ* BARNARD CASTLE GIFT SHOP

PAYPAL *ARGOS EBAY

MCDONALDS (VIA GOOGLE PAY)

PPOINT_*PREMIER STORE

AMZ*National Express

SUMUP *SLIMMING WORLD

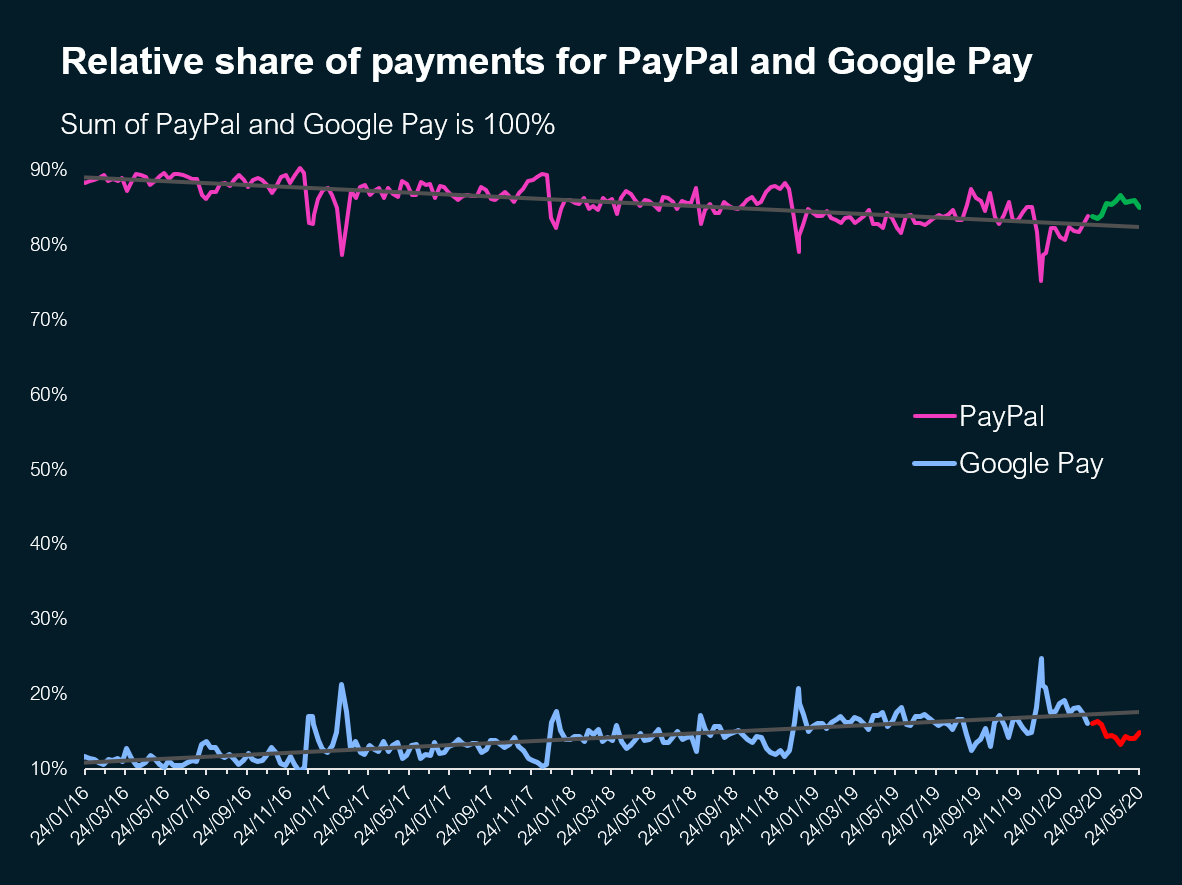

As part of our investigation into the impact of Covid-19 – which we are taking to be the main driver of the trends we have seen – we have looked at trends in transaction string patterns to see what changes there have been in recent months at the payment processor level, as well as at the macro and category spend level. Since the UK went into lockdown, payment processor market shares have shifted: there has been a resurgence in PayPal and a fall in the share to Google Pay down to 15% share as trips to stores fall away and online shopping has surged.

Other payment providers have suffered even more. Those providing terminals and processing to many independent pubs, cafes and market stalls have seen transactions plummet since many of these businesses have shut or been open for takeaway or delivery only. Some payment providers work very well for market stalls selling food via contactless payment, but do not easily pivot to support eCommerce payments where the card is not present.

The biggest falls have come from parking payment providers since under lockdown most people have not been driving (unless they need to test their eyesight). But, it’s not all bad news. With lockdown and working from home as the new normal, customer habits have shifted towards eCommerce and shopping locally, meaning that Amazon Pay, payment providers focused on spreading purchases over time, and those used in corner shops have gained share.

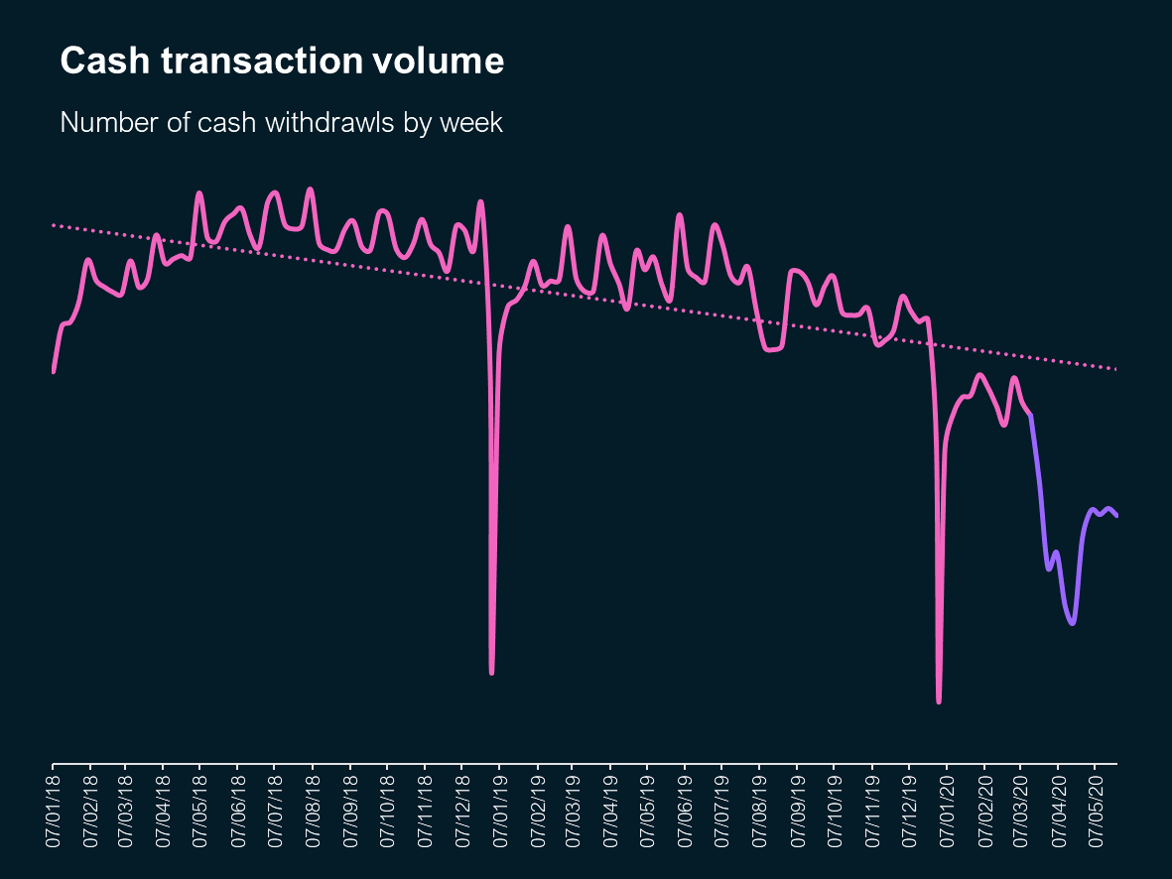

Cash use is in long-term decline. Ten years ago 60% of payments were cash. Contactless payments continue to rise and have become more acceptable to older people in the last few years. The limit rose from £30 to £45 on contactless on 1st April. Contactless payments became even more attractive during the first spike of Covid-19 infections since they protect the customer and the shop worker from handling coins and notes.

Cash withdrawals dropped during lockdown and are at about half the level that we would expect to see. Many shops have been shut, you cannot use cash online and many cash-in-hand workers have been unable to work. The last three weeks have seen a partial rebound. The general move from cash to cards is a great opportunity for the Alternative Data market since coverage is increasing and the quality of our signal on the consumer economy can only rise.

For more information about our data and our Data Science team, you can contact Dr Mark Howland, Chief Data Scientist at mark@fabledata.com

*This piece was based on insight derived from identifying payment processors in the Fable Data Panel of anonymised European consumer spend.